Yet Another Disruptor in Global Value Chains is Imminent: The European Union Green Deal’s Circular Economy Regulations

Karina Fernandez-Stark and Penny Bamber

Jul, 2024

#Sustainability standards

As the world seeks to address the significant challenges faced by climate change, the EU has launched the European Green Deal (EGD), an ambitious new agenda to ensure the region’s climate neutrality by 2050. Deviating from past voluntary-based approaches, this bold new plan aims to legislate the sustainability of every aspect of every product on its market. Included in the EGD’s vast agenda is proposed circular economy legislation that aims to ensure all products sold in the EU are more durable, reliable, reusable, reparable, and recyclable. As the world’s largest importer, these EU initiatives, if fully implemented, will likely have far-reaching consequences and significantly transform the global economy. This would affect all stages of every GVC catering to the EU. It is uncertain how supplier countries will respond to these proposed regulations and how the EU’s circular economy agenda could reshape global value chains. Inevitably, there will be winners and losers.

What are the key legislative initiatives of the EGD’s Circular Economy Action Plan?

Since the launch of the European Green Deal in 2019, the EU has set out to introduce legislation to ensure its swift and broad adoption. These efforts began with the publication of the Circular Economy Action Plan (CEAP) in March 2020, which became the central building block to operationalizing the EU’s sustainability goals. The CEAP has been complemented by the Fit-for-55 legislative package and revisions to major directives, including Industrial Emissions, Waste Management, Waste Shipment, and End-of-Life recycling. To ensure the sustainability of all other products not yet covered by specific legislation, in March 2022, under the banner of the Sustainable Products Initiative, the European Commission moved ahead with the proposal for the Ecodesign for Sustainable Products Regulation (ESPR). A provisional agreement on this proposal was reached between the European Commission, the European Parliament, and the European Council in December 2023, setting it up to be formalized and come into effect in 2024 (European Commission, 2023a). The agreed ESPR legislation explicitly covers all products on the EU market – from raw materials and intermediates to final goods with each set of goods being governed by product-specific legislation in recognition of the fact that not all products have equal environmental impact. This is a pioneering, comprehensive framework that aims to regulate the sustainability of all products in the EU market (European Commission, 2022a). While the legislation will allow for the progressive implementation of requirements, in the not-too-distant future, all products will be required to last longer with considerable options for repair, and information about their sustainability will need to be disclosed through a Digital Product Passport, accessible to regulators and consumers alike.

How will this legislation impact global value chains?

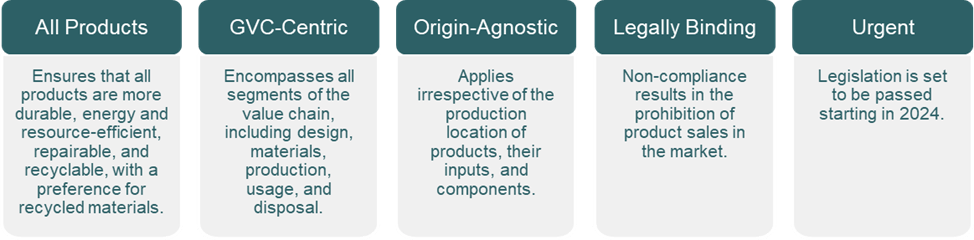

The anticipated changes in performance, sustainability, and production required by this legislative drive are monumental. The first of their kind globally, the new regulations will cover all products on the market and all stages of the GVC from the beginning of the chain to the end. Furthermore, these legally binding requirements will apply to the product, regardless of its place of production, thereby directly exposing firms all over the world to the EU demands.

The EPSR framework legislation is to be complemented with product-specific Delegated Acts over the next decade, meaning that many of the precise technical details each sector must meet are still up for discussion. Yet, the core principles of the legislation have been agreed upon: to transform products, making them circular and sustainable by changing the way they are designed, the materials they use, and how they’re made, used, and disposed of. Its ambitious objective is to ensure products are durable, reliable, reusable, repairable, and recyclable, with a focus on incorporating the highest recycled content and minimizing emissions. This aims to reduce waste and enhance resource use throughout the value chain, covering design, inputs, and production. Upstream, these regulations will undoubtedly impact the utilization of raw materials, from inputs to final products. Some raw materials may face complete prohibition or be restricted to recycled alternatives, prompting modifications in extraction and processing methods to reduce water and energy usage and minimize pollution. Downstream, these regulations will alter how products must be repaired, reused, or disposed of, and may also decrease the demand for final products. Despite the ongoing discussions of product-specific requirements, sustainability strategies from the European Commission since 2020 provide insights into the anticipated directions. For instance, the EU Strategy for Sustainable and Circular Textiles aims to promote textile products made mostly from recycled fibers, without harmful substances and produced in a way that respects people’s rights and the environment. They’re also pushing for a thriving market for used textiles and easy access to repair services (European Commission, 2022b).

The European Union’s substantial engagement in GVCs implies that its legislation will exert far-reaching effects on global industries. As the largest single importer globally, accounting for 40% of total global goods imports, the EU is deeply embedded in most global value chains. These chains are complex, involving the sourcing of raw materials, intermediates, and final products from various regions worldwide. Compliance with EU circularity regulations will necessitate actions at every stage of these chains regardless of where these occur. This will ultimately impact businesses and workers around the world. For instance, policies aiming to reduce material consumption in product manufacturing will hit countries exporting raw materials like aluminum, cotton, iron, steel, rubber, and wood. Elevating durability and sustainability standards for intermediates and final goods will prompt adjustments in production processes to minimize energy intensity and pollution while simultaneously dampening demand. Legislative advances to date indicate that non-compliance will result in exclusion from chains serving the EU market.

The EU also explicitly aims to spread its CE business model by shaping global standards. Through the CEAP, the EU not only sets the goal to make sustainable products the norm in the EU market but also aims to influence international efforts towards a more circular global economy (European Commission, 2020). As a major global market, the region wields significant influence over other economies, which it exerts through the internationalization of its leading firms, and the globalization of its standards. While some countries will opt for looser regulations – creating markets for non-EU-compliant products, past experience illustrates that developed country markets often adopt EU standards to align with their best practices and facilitate international trade. The agricultural industry offers one such example; the adoption of the EurepGap standard directly influenced the creation of GlobalGap, a demanding production standard required by all major markets around the world and a prerequisite for participating in numerous high-value agriculture GVCs (Fernandez-Stark et al., 2011, 2012). Producers who are unable to meet these standards usually are forced to serve lower-value markets or exit the industry.

The EPSR framework legislation is to be complemented with product-specific Delegated Acts over the next decade, meaning that many of the precise technical details each sector must meet are still up for discussion. Yet, the core principles of the legislation have been agreed upon: to transform products, making them circular and sustainable by changing the way they are designed, the materials they use, and how they’re made, used, and disposed of. Its ambitious objective is to ensure products are durable, reliable, reusable, repairable, and recyclable, with a focus on incorporating the highest recycled content and minimizing emissions. This aims to reduce waste and enhance resource use throughout the value chain, covering design, inputs, and production. Upstream, these regulations will undoubtedly impact the utilization of raw materials, from inputs to final products. Some raw materials may face complete prohibition or be restricted to recycled alternatives, prompting modifications in extraction and processing methods to reduce water and energy usage and minimize pollution. Downstream, these regulations will alter how products must be repaired, reused, or disposed of, and may also decrease the demand for final products. Despite the ongoing discussions of product-specific requirements, sustainability strategies from the European Commission since 2020 provide insights into the anticipated directions. For instance, the EU Strategy for Sustainable and Circular Textiles aims to promote textile products made mostly from recycled fibers, without harmful substances and produced in a way that respects people’s rights and the environment. They’re also pushing for a thriving market for used textiles and easy access to repair services (European Commission, 2022b).

The European Union’s substantial engagement in GVCs implies that its legislation will exert far-reaching effects on global industries. As the largest single importer globally, accounting for 40% of total global goods imports, the EU is deeply embedded in most global value chains. These chains are complex, involving the sourcing of raw materials, intermediates, and final products from various regions worldwide. Compliance with EU circularity regulations will necessitate actions at every stage of these chains regardless of where these occur. This will ultimately impact businesses and workers around the world. For instance, policies aiming to reduce material consumption in product manufacturing will hit countries exporting raw materials like aluminum, cotton, iron, steel, rubber, and wood. Elevating durability and sustainability standards for intermediates and final goods will prompt adjustments in production processes to minimize energy intensity and pollution while simultaneously dampening demand. Legislative advances to date indicate that non-compliance will result in exclusion from chains serving the EU market.

The EU also explicitly aims to spread its CE business model by shaping global standards. Through the CEAP, the EU not only sets the goal to make sustainable products the norm in the EU market but also aims to influence international efforts towards a more circular global economy (European Commission, 2020). As a major global market, the region wields significant influence over other economies, which it exerts through the internationalization of its leading firms, and the globalization of its standards. While some countries will opt for looser regulations – creating markets for non-EU-compliant products, past experience illustrates that developed country markets often adopt EU standards to align with their best practices and facilitate international trade. The agricultural industry offers one such example; the adoption of the EurepGap standard directly influenced the creation of GlobalGap, a demanding production standard required by all major markets around the world and a prerequisite for participating in numerous high-value agriculture GVCs (Fernandez-Stark et al., 2011, 2012). Producers who are unable to meet these standards usually are forced to serve lower-value markets or exit the industry.

Figure 1. Key Characteristics of the European Green Deal Approach to Sustainability

What are the potential implications of the proposed regulations for countries that participate in GVCs?

#1. Non-compliance means exclusion. Failure to meet the extensive requirements could eventually mean the exclusion of exports from the EU market. As the EU is the largest trade partner for 80 countries (European Commission, 2023b), many countries could face an elevated risk of direct negative impacts on their exports.

#2. Compliance is costly. With anticipated changes required to every production process from material changes to water use and the incorporation of renewable electricity, a significant amount of new public and private infrastructure will be required. This will demand large-scale investments.

#3. Sourcing sustainable raw materials is critical. The new legislative push would require manufacturers to source either certified sustainable raw materials or recycled ones. This may require major modifications in upstream supply to reduce environmental impacts in production or extraction. It will also drive the need for recycling ecosystems which are mostly absent in developing countries.

#4. New talent is needed. New skill sets will need to be developed to support this process; from assessment of key environmental criteria to modifications across sourcing and production, implementation of recycling operations, and provision of end-to-end traceability. The limited supply of relevant technicians and professionals in many countries would need to be augmented.

#5. Innovative technological solutions must be developed and deployed. Several of the proposed regulatory changes are not currently achievable from a technical standpoint. Globally, the technologies needed to produce fully sustainable products are still in their infancy. Greater efforts will be needed to mobilize and commercialize R&D and innovation across GVC players.

#6. Yet, new opportunities abound. First movers to meet the EU’s requirements have the opportunity to differentiate themselves from low-cost rivals worldwide, enhance their reputations as sustainable suppliers, and attract a new client base. New recycling sectors will boom. At the same time, there is significant scope for innovation; suppliers will need to develop new processes, products, and services to align with environmental standards.

Policymakers in countries engaged in Global Value Chains (GVCs) that serve the EU market will need to proactively prepare their industries for the pipeline of upcoming requirements to mitigate potential negative consequences. As the regulations are progressively rolled out, the impact is anticipated to be most significant on smaller enterprises in developing countries, given their limited financial, administrative, and technological capabilities. If small and medium-sized enterprises (SMEs) are excluded from GVCs, it could lead to increased consolidation within the supply base, favoring fewer, larger, and more globally integrated suppliers. The responses of firms and countries worldwide could play a pivotal role in reshaping supply chains.

#2. Compliance is costly. With anticipated changes required to every production process from material changes to water use and the incorporation of renewable electricity, a significant amount of new public and private infrastructure will be required. This will demand large-scale investments.

#3. Sourcing sustainable raw materials is critical. The new legislative push would require manufacturers to source either certified sustainable raw materials or recycled ones. This may require major modifications in upstream supply to reduce environmental impacts in production or extraction. It will also drive the need for recycling ecosystems which are mostly absent in developing countries.

#4. New talent is needed. New skill sets will need to be developed to support this process; from assessment of key environmental criteria to modifications across sourcing and production, implementation of recycling operations, and provision of end-to-end traceability. The limited supply of relevant technicians and professionals in many countries would need to be augmented.

#5. Innovative technological solutions must be developed and deployed. Several of the proposed regulatory changes are not currently achievable from a technical standpoint. Globally, the technologies needed to produce fully sustainable products are still in their infancy. Greater efforts will be needed to mobilize and commercialize R&D and innovation across GVC players.

#6. Yet, new opportunities abound. First movers to meet the EU’s requirements have the opportunity to differentiate themselves from low-cost rivals worldwide, enhance their reputations as sustainable suppliers, and attract a new client base. New recycling sectors will boom. At the same time, there is significant scope for innovation; suppliers will need to develop new processes, products, and services to align with environmental standards.

Policymakers in countries engaged in Global Value Chains (GVCs) that serve the EU market will need to proactively prepare their industries for the pipeline of upcoming requirements to mitigate potential negative consequences. As the regulations are progressively rolled out, the impact is anticipated to be most significant on smaller enterprises in developing countries, given their limited financial, administrative, and technological capabilities. If small and medium-sized enterprises (SMEs) are excluded from GVCs, it could lead to increased consolidation within the supply base, favoring fewer, larger, and more globally integrated suppliers. The responses of firms and countries worldwide could play a pivotal role in reshaping supply chains.

References

European Commission. (2020). Circular Economy Action Plan. Retrieved March 14, 2023, from https://environment.ec.europa.eu/strategy/circular-economy-action-plan_en.

---. (2022a). Ecodesign For Sustainable Products. Retrieved March, 14, 2023, from https://commission.europa.eu/energy-climate-change-environment/standards-tools-and-labels/products-labelling-rules-and-requirements/sustainable-products/ecodesign-sustainable-products_en.

---. (2022b). EU Strategy For Sustainable And Circular Textiles. Environment Retrieved March, 15, 2023, from https://environment.ec.europa.eu/strategy/textiles-strategy_en.

---. (2023a). Commission welcomes provisional agreement for more sustainable, repairable and circular products. https://ec.europa.eu/commission/presscorner/detail/en/ip_23_6257.

---. (2023b). EU position in world trade. EU trade relationships by country/region Retrieved November 30, 2023, from https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/eu-position-world-trade_en.

Fernandez-Stark, Karina, Penny Bamber and Gary Gereffi. (2011). Workforce Development in the Fruit and Vegetable Global Value Chain. In G. Gereffi, K. Fernandez-Stark & P. Psilos (Eds.), Skills for Upgrading: Workforce Development and Global Value Chains in Developing Countries. Durham: Center on Globalization Governance & Competitiveness and RTI International.

---. (2012). Inclusion of Small- and Medium-Sized Producers in High-Value Agro-Food Value Chains. Durham N.C.: Duke Global Value Chain Center for the Inter-American Development Bank Multilateral Investment Fund (IDB-MIF). https://gvcc.duke.edu/cggclisting/inclusion-of-small-and-medium-sized-producers-in-high-value-agro-food-value-chains/.

European Commission. (2020). Circular Economy Action Plan. Retrieved March 14, 2023, from https://environment.ec.europa.eu/strategy/circular-economy-action-plan_en.

---. (2022a). Ecodesign For Sustainable Products. Retrieved March, 14, 2023, from https://commission.europa.eu/energy-climate-change-environment/standards-tools-and-labels/products-labelling-rules-and-requirements/sustainable-products/ecodesign-sustainable-products_en.

---. (2022b). EU Strategy For Sustainable And Circular Textiles. Environment Retrieved March, 15, 2023, from https://environment.ec.europa.eu/strategy/textiles-strategy_en.

---. (2023a). Commission welcomes provisional agreement for more sustainable, repairable and circular products. https://ec.europa.eu/commission/presscorner/detail/en/ip_23_6257.

---. (2023b). EU position in world trade. EU trade relationships by country/region Retrieved November 30, 2023, from https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/eu-position-world-trade_en.

Fernandez-Stark, Karina, Penny Bamber and Gary Gereffi. (2011). Workforce Development in the Fruit and Vegetable Global Value Chain. In G. Gereffi, K. Fernandez-Stark & P. Psilos (Eds.), Skills for Upgrading: Workforce Development and Global Value Chains in Developing Countries. Durham: Center on Globalization Governance & Competitiveness and RTI International.

---. (2012). Inclusion of Small- and Medium-Sized Producers in High-Value Agro-Food Value Chains. Durham N.C.: Duke Global Value Chain Center for the Inter-American Development Bank Multilateral Investment Fund (IDB-MIF). https://gvcc.duke.edu/cggclisting/inclusion-of-small-and-medium-sized-producers-in-high-value-agro-food-value-chains/.