Unpopular, but strategically necessary: why Europe needs domestic resource extraction

Frank Umbach

Apr, 2024

#Mining

#EU / Western Europe

#Energy

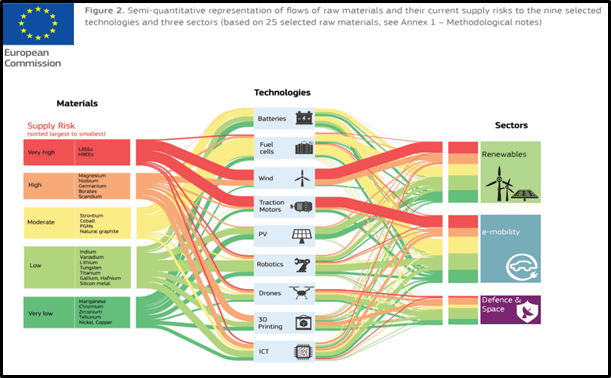

The geo-economic and geopolitical importance of securing a future supply of critical raw materials (CRMs) has been severely neglected by European governments and industries over the past decade. But experts have been sounding the alarm on this matter for years. CRMs are not only essential for civilian technologies including renewable energies, electric batteries, and digitalization technologies, but also for the defense and space industries (see Figure 1). The EU defines CRMs to include lithium, copper, cobalt, nickel, rare earths, platinum, and numerous other minerals. Until recently, the discussion about the security of raw material supply remained largely isolated from the issue of energy security. But future energy security will be closely linked to raw material supply security and new import dependencies with geopolitical implications.[1]

Figure 1:

With the Critical Raw Materials Act (CRMA) proposed by the EU Commission in March 2023, the EU attempts to provide an adequate response to the numerous challenges related to the security of raw material supply, electric mobility, and battery industries. The EU's need for a stable, sustainable, and sufficient supply of CRMs for its economy, the expansion of renewable energies, decarbonization, digitalization technologies and the rising demand in the European defense industry will continue to increase significantly in the future.

Two challenges exist in this context:

Two challenges exist in this context:

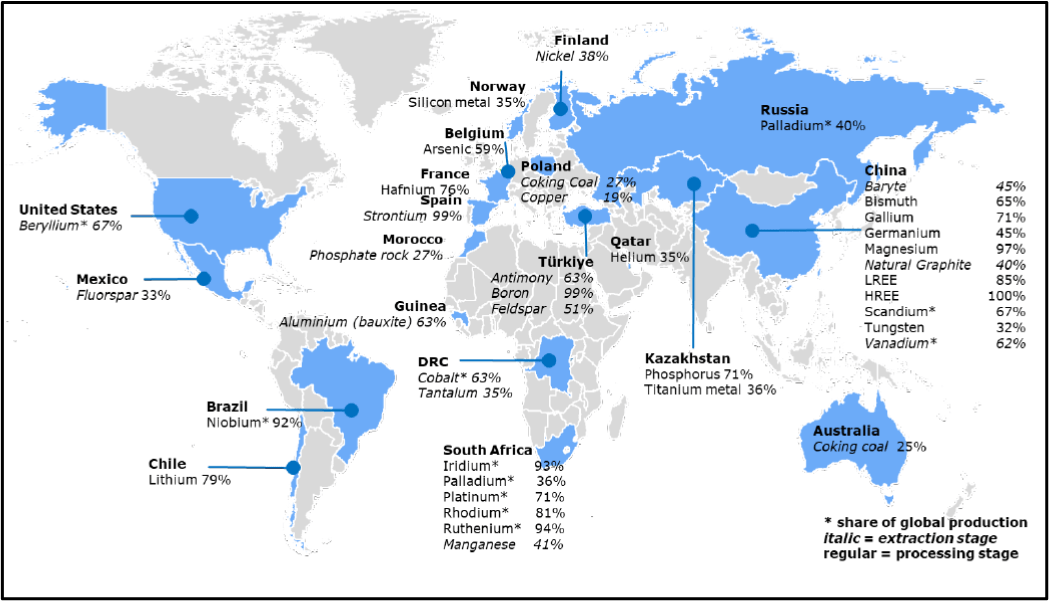

- Some experts and organizations are warning of a global geopolitical conflict over access to mines of CRMs and processing capacities. Both are often limited to few supplier countries and regions.[2] The geo-economic and geopolitical importance of the future worldwide oil and natural gas (incl. LNG) supplies is increasingly being overshadowed by global demand for CRMs. Notably, the EU’s dependence on China as a supplier of CRMs and intermediate products remains significantly higher than its past dependence on Russian gas and oil (see Figure 2). In a maritime territorial conflict in 2010, China already demonstrated its willingness to use Japan’s high dependence on Chinese rare earths to exert political pressure. As the US’ and the EU's geo-economic and geopolitical relationship with China becomes more contentious, European dependency on raw materials that are critical for new disruptive technology supply chains (such as storage, 5G, or AI technologies) are moving to the centre of political attention.

Figure 2: The EU's main raw material suppliers and raw material import dependencies

- Global raw material security is not only endangered by the rapidly rising demand for CRMs but also by the fact that it takes an average of seven years from planning a new raw material mine to its actual production. In Western democracies, this period can extend to ten to 15 years due to low local acceptance and complex bureaucratic processes resulting from national and local environmental requirements and regulations. This uncertainty has deterred investors over the past decade. However, the current lack of substantial investments in new raw material mines threatens the future security of raw material supply and, consequently, the global energy transition and efforts to reduce global warming.

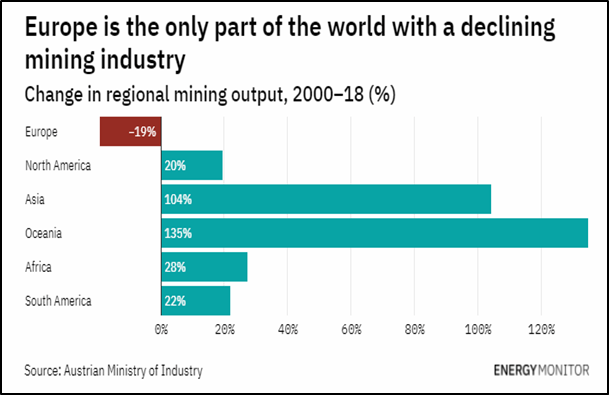

Until recently, the prevailing assumption in politics and industries has been that the security of supply could be largely entrusted to free markets and the industry itself. Unlike the approach taken with oil and gas, neither the member states nor the EU as a whole have made provisions for strategic raw material stockpiling. At present, the EU-27 can only satisfy approximately 8% of its raw material demand internally. Furthermore, Europe held a mere 5% share of global mining in 2020 and is the sole region worldwide experiencing a prolonged decline in its mining industry.[3]

Figure 3: The Decline of the European Mining Industry in International Comparison

The growing concern and geo-economic importance of CRMs are reflected in the EU's list of CRMs, which is updated at least every three years. The number of CRMs has increased from 14 in 2011 to 20 in 2014, 27 in 2017, 30 in 2020, and 34 in 2023. The main challenges that the EU is facing will be to ensure non-discriminatory access to CRMs and to strengthen domestic material securing, extraction, and processing. The global environment is rapidly changing as critical supply chains become more fragmented due to competition and conflict between Western democracies and autocratic-dictatorial systems in Russia, China, and the global south. The EU is adopting a "de-risking" approach, which entails diversifying supply chains and building domestic strategic reserve capacities while maintaining a division of labor in global value chains, including with China. In contrast, China has been pursuing a de facto "de-coupling" policy for years, aiming for self-sufficiency, reduced dependence on the West (particularly the US) and further increasing Western dependence on China.

Since 2021, Beijing has intensified its efforts to secure its own raw material supply by building larger strategic reserves, making the world more reliant on China. Globally, China is the only superpower in the clean tech supply chain that has systematically positioned itself in this manner through a long-term policy dating back to the 1980s. China continues to strengthen its strategic control of key supply chains for disruptive technologies and related critical raw materials.[4] In early July 2023, for instance, the Chinese Ministry of Commerce implemented new export controls for gallium and germanium metals, crucial for semiconductor and chip manufacturing, among other applications. China dominates global gallium production (98%) and global germanium processing capacity (68%). These geo-economic and geopolitical trends compel the EU to reevaluate long-standing (mis)assumptions and self-assurance in their China, raw material supply and global trade policies.

Since 2021, Beijing has intensified its efforts to secure its own raw material supply by building larger strategic reserves, making the world more reliant on China. Globally, China is the only superpower in the clean tech supply chain that has systematically positioned itself in this manner through a long-term policy dating back to the 1980s. China continues to strengthen its strategic control of key supply chains for disruptive technologies and related critical raw materials.[4] In early July 2023, for instance, the Chinese Ministry of Commerce implemented new export controls for gallium and germanium metals, crucial for semiconductor and chip manufacturing, among other applications. China dominates global gallium production (98%) and global germanium processing capacity (68%). These geo-economic and geopolitical trends compel the EU to reevaluate long-standing (mis)assumptions and self-assurance in their China, raw material supply and global trade policies.

Strengthening domestic raw material extraction and processing capacities versus local acceptance

The situation is further complicated by the EU's proposal to impose sanctions on Russian exports of critical raw materials to the EU. This move aims to increase pressure on the Kremlin and limit the funding base for the Russian war on Ukraine. Russia is a major exporter of iron ore, gold, uranium, phosphates, palladium, and other raw materials. The current European Commission proposal covers approximately 30% of Russia's annual commodity exports to the EU, valued at €99 billion in 2021.

Against this backdrop, the CRMA outlines the following targets and capacities for the EU’s strategic commodity value chain and the diversification of EU imports in the medium term until 2030:

The CRMA also aims to reduce administrative burdens and shorten authorization procedures for critical extractive projects in the EU to a maximum of 24 months for extractive projects and 12 months for processing and recycling projects, while maintaining high social and environmental standards. Additionally, selected strategic projects are slated to receive financial support, as seen in Spain, Portugal, Serbia, Sweden, and Norway, with shorter authorization periods.

In the best-case scenario, the EU will be able to mine approximately 30% of its own raw material demand in Europe in the future. Nevertheless, this is highly uncertain, primarily due to lacking social acceptance for domestic mining, particularly at the local level, and especially in densely populated member states like Germany. This creates a conflict of objectives. Politicians to balance local environmental and global climate protection (as in the case of concessions for onshore wind turbines). Green parties and environmental NGOs often attempt to negate, marginalize, or avoid discussing this issue in public, or they seek to stifle further debate arguing that recycling is the ultimate (silver bullet) solution.

CRM mining within Europe is now more critical than ever, as (1) they are prerequisites for accelerating the adoption of electromobility as well as the extensive expansion of renewable energies and energy storage systems; and (2) European raw material mines would result in significantly lower CO2-emissions due to stringent EU environmental regulations (in comparison with China, Africa or Latin America) and shorter transportation routes compared to a high volume of raw material imports from Latin America, Africa, and Asia (particularly China).

Hence, domestic raw material extraction bolsters both Europe's security of supply and global climate protection. While CRM demand saving and recycling are vital for a circular economy and raw material conservation, it alone cannot meet the entire European raw material demand. Moreover, for many raw materials, there is no viable technological recycling option yet, necessitating substantial technological innovations or a compelling business case for private companies. Alternative technology options and CRM substitution are often not so much efficient or produce higher emissions in the extraction and refining processes. [5] As there is no “silver bullet”-solution to the worldwide rapidly increasing demand of CRMs for the global decarbonization, digitalization and disruptive technologies (including AI), domestic raw material extraction will become an important strategic instrument for the future EU CRM supply security in a fragmented world, in which “geopolitics now trump capital markets” and global trade.[6]

Against this backdrop, the CRMA outlines the following targets and capacities for the EU’s strategic commodity value chain and the diversification of EU imports in the medium term until 2030:

- at least 10% of annual EU consumption is to be covered by raw material production within the EU;

- at least 40% of annual EU consumption is to come from own processing (compared to the current range of 0 to 20%);

- at least 15% of annual EU consumption is to be secured through recycling;

- a maximum of 65% of the EU's annual consumption of each strategic raw material at all stages of processing may be imported from a single third country.

The CRMA also aims to reduce administrative burdens and shorten authorization procedures for critical extractive projects in the EU to a maximum of 24 months for extractive projects and 12 months for processing and recycling projects, while maintaining high social and environmental standards. Additionally, selected strategic projects are slated to receive financial support, as seen in Spain, Portugal, Serbia, Sweden, and Norway, with shorter authorization periods.

In the best-case scenario, the EU will be able to mine approximately 30% of its own raw material demand in Europe in the future. Nevertheless, this is highly uncertain, primarily due to lacking social acceptance for domestic mining, particularly at the local level, and especially in densely populated member states like Germany. This creates a conflict of objectives. Politicians to balance local environmental and global climate protection (as in the case of concessions for onshore wind turbines). Green parties and environmental NGOs often attempt to negate, marginalize, or avoid discussing this issue in public, or they seek to stifle further debate arguing that recycling is the ultimate (silver bullet) solution.

CRM mining within Europe is now more critical than ever, as (1) they are prerequisites for accelerating the adoption of electromobility as well as the extensive expansion of renewable energies and energy storage systems; and (2) European raw material mines would result in significantly lower CO2-emissions due to stringent EU environmental regulations (in comparison with China, Africa or Latin America) and shorter transportation routes compared to a high volume of raw material imports from Latin America, Africa, and Asia (particularly China).

Hence, domestic raw material extraction bolsters both Europe's security of supply and global climate protection. While CRM demand saving and recycling are vital for a circular economy and raw material conservation, it alone cannot meet the entire European raw material demand. Moreover, for many raw materials, there is no viable technological recycling option yet, necessitating substantial technological innovations or a compelling business case for private companies. Alternative technology options and CRM substitution are often not so much efficient or produce higher emissions in the extraction and refining processes. [5] As there is no “silver bullet”-solution to the worldwide rapidly increasing demand of CRMs for the global decarbonization, digitalization and disruptive technologies (including AI), domestic raw material extraction will become an important strategic instrument for the future EU CRM supply security in a fragmented world, in which “geopolitics now trump capital markets” and global trade.[6]

Endnotes:

[1] See IEA, The Role of Critical World Energy Outlook. Special Report Minerals in Clean Energy Transitions World, Paris 2022; OECD, Global Material Resources Outlook to 2060. Economic Drivers and Environmental Consequences, Paris 2020; World Bank Group,,The Growing Role of Minerals and Metals for a Low Carbon Future", Washington D.C., June 2017; UNEP, Green Technology Choices: The Environmental and Resource Implications of Low-Carbon Technologies, Nairobi-Paris, 2017; F. Umbach, Energy Security in a Digitalized World and its Geostrategic Implications, Konrad Adenauer Stiftung-Hong Kong, September 2018, and idem, The New 'Rare Metal Age'. New Challenges and Implications of Critical Raw Materials' Supply Security in the 21st Century, Working Paper No. 329, S. Rajaratnam School of International Studies (RSIS)/ Nanyan Technological University NTU, Singapore, 27 April 2020.

[2] The dependence of the US defense industry on China for critical raw materials, such as rare earths, and their processing capacities has become an increasingly important issue at the level of the US government for about a decade. It now occupies a central place on the US security agenda in the course of geo-economic and geopolitical competition with China, including in the Pentagon. As a result, this geopolitical conflict has also manifested itself in disputes between the two sides over access to rare earths and other raw materials in Greenland - see also F.Umbach, Critical raw materials: the return of the issue of security of supply to the international agenda, in: European Security & Technology (ES&T), September 2019, pp. 52-55; idem, Rare Earth Minerals Return to the U.S. Security Agenda, Geopolitical Intelligence Service (GIS), 1 August 2019 (https://www.gisreportsonline.com/r/rare-earth-minerals/ ); and here p.1f. (https://www.rsis.edu.sg/wp-content/uploads/2020/04/WP329_V2.pdf) and The Fight for Greenland's Resources, Stratfor.com, 2 June 2021.

[3] See Nick Ferris, Why Critical Mineral Supplies won't Scupper the Energy Transition, Energy Monitor, 23.6.2021 (https://www.energymonitor.ai/finance/risk-management/why-we-need-a-level-headed-approach-to-energy-transition-minerals/; accessed 11.8.2023).

[4] See D.S. Abraham, The Elements of Power: Gadgets, Guns, and the Struggle for a Sustainable Future in the Rare Metal Age (New Heaven: Yale University Press, 2015); Ann Bridges, Rare Mettle. A Silicon Valley Novel (EndSource Management, Revised Edition 2017); Victoria Bruce, Sellout. How Washington Gave away America's Technological Soul and One Man's Fight to Bring It Home (New York-London et al., Bloomsbury 2017); Luc Leruth, Green Energy Depends on Critical Minerals: Who Controls the Supply Chains?, Peterson Institute for International Economies, Working Paper, August 2022 and Cindy Hurst, China's Rare Earth Elements Industry: What Can the West Learn?", Institute for Analysis of Global Security (IAGS), March 2010.

[5] See F. Umbach, Energy Security in a Digitalized World and its Geostrategic Implications, pp. 117ff.

[6] Quoted following: McKinsey & Company, ‚How to Develop Geopolitical Resilience’, November 2023, p. 6. See also in context Henry Farrell/Abraham Newman, ‘The new Economic Security State’, Foreign Affairs, November-December 2023.

[1] See IEA, The Role of Critical World Energy Outlook. Special Report Minerals in Clean Energy Transitions World, Paris 2022; OECD, Global Material Resources Outlook to 2060. Economic Drivers and Environmental Consequences, Paris 2020; World Bank Group,,The Growing Role of Minerals and Metals for a Low Carbon Future", Washington D.C., June 2017; UNEP, Green Technology Choices: The Environmental and Resource Implications of Low-Carbon Technologies, Nairobi-Paris, 2017; F. Umbach, Energy Security in a Digitalized World and its Geostrategic Implications, Konrad Adenauer Stiftung-Hong Kong, September 2018, and idem, The New 'Rare Metal Age'. New Challenges and Implications of Critical Raw Materials' Supply Security in the 21st Century, Working Paper No. 329, S. Rajaratnam School of International Studies (RSIS)/ Nanyan Technological University NTU, Singapore, 27 April 2020.

[2] The dependence of the US defense industry on China for critical raw materials, such as rare earths, and their processing capacities has become an increasingly important issue at the level of the US government for about a decade. It now occupies a central place on the US security agenda in the course of geo-economic and geopolitical competition with China, including in the Pentagon. As a result, this geopolitical conflict has also manifested itself in disputes between the two sides over access to rare earths and other raw materials in Greenland - see also F.Umbach, Critical raw materials: the return of the issue of security of supply to the international agenda, in: European Security & Technology (ES&T), September 2019, pp. 52-55; idem, Rare Earth Minerals Return to the U.S. Security Agenda, Geopolitical Intelligence Service (GIS), 1 August 2019 (https://www.gisreportsonline.com/r/rare-earth-minerals/ ); and here p.1f. (https://www.rsis.edu.sg/wp-content/uploads/2020/04/WP329_V2.pdf) and The Fight for Greenland's Resources, Stratfor.com, 2 June 2021.

[3] See Nick Ferris, Why Critical Mineral Supplies won't Scupper the Energy Transition, Energy Monitor, 23.6.2021 (https://www.energymonitor.ai/finance/risk-management/why-we-need-a-level-headed-approach-to-energy-transition-minerals/; accessed 11.8.2023).

[4] See D.S. Abraham, The Elements of Power: Gadgets, Guns, and the Struggle for a Sustainable Future in the Rare Metal Age (New Heaven: Yale University Press, 2015); Ann Bridges, Rare Mettle. A Silicon Valley Novel (EndSource Management, Revised Edition 2017); Victoria Bruce, Sellout. How Washington Gave away America's Technological Soul and One Man's Fight to Bring It Home (New York-London et al., Bloomsbury 2017); Luc Leruth, Green Energy Depends on Critical Minerals: Who Controls the Supply Chains?, Peterson Institute for International Economies, Working Paper, August 2022 and Cindy Hurst, China's Rare Earth Elements Industry: What Can the West Learn?", Institute for Analysis of Global Security (IAGS), March 2010.

[5] See F. Umbach, Energy Security in a Digitalized World and its Geostrategic Implications, pp. 117ff.

[6] Quoted following: McKinsey & Company, ‚How to Develop Geopolitical Resilience’, November 2023, p. 6. See also in context Henry Farrell/Abraham Newman, ‘The new Economic Security State’, Foreign Affairs, November-December 2023.