Taking advantage of Global Value Chains to spread green energy technologies across countries

Vito Amendolagine, Ulrich Elmer Hansen, Rasmus Lema, Roberta Rabellotti, Dalila Ribaudo

Apr, 2024

#Trade and FDI

#Environment and climate change

#Energy

Renewable energy technologies, such as wind turbines and solar photovoltaic (PV), are key to achieve a low-carbon transition and make our planet greener (Pegels and Altenburg, 2020). While countries in Europe have previously been the lead markets, the development and diffusion of renewable energy technologies are increasingly taking place on a global scale, including in several latecomer countries (IEA, 2018b; IRENA and ADFD, 2020; UNCTAD, 2023). A recent article featured in World Development (Amendolagine et al., 2023) delves into how multinational enterprises’ (MNEs) subsidiaries can positively spur the development of green innovation in countries at different levels of development and kickstart their green transition.

Just a few MNEs worldwide play a central role in diffusing the technological hardware and the knowledge necessary to achieve a low-carbon transition in the local economies hosting their subsidiaries. Since these MNEs control the functional division of labour throughout the value chain (Dallas et al., 2019), they can potentially provide their local affiliates with the strategic resources and knowledge needed to engage in innovation in the domestic markets (Lema et al., 2019). Therefore, knowledge transfer within the Global Value Chains (GVCs) is an important channel, possibly driving the diffusion of international low-carbon technologies, and overcoming the lack of knowledge and technology, which is often reported as a key barrier to achieving the green energy transition, especially in less developed countries (IRENA, 2017).

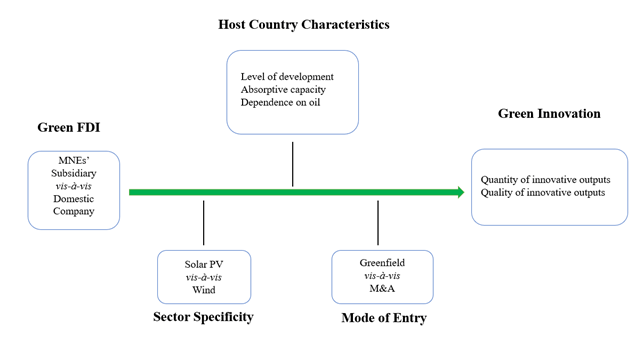

The paper by Amendolagine et al., 2023 provide new insights on how foreign investments in green technologies can contribute to greening the host countries. Following the conceptual framework illustrated in Figure 1, the research explores to what extent foreign direct investments (FDIs) in renewable energy technologies, contribute to the increase in the green innovative capabilities of their subsidiaries vis-à-vis domestic companies. Three key moderating factors are investigated: a) host country characteristics, accounting for differences among countries at different levels of economic development (Awijen et al., 2022; Noailly and Ryfisch, 2015); b) technology specificity, exploring the differences between solar PV and wind (Binz and Truffer, 2017; Quitzow et al., 2017); c) MNE entry mode, distinguishing between greenfield investments and acquisitions (Amendolagine et al., 2021).

Just a few MNEs worldwide play a central role in diffusing the technological hardware and the knowledge necessary to achieve a low-carbon transition in the local economies hosting their subsidiaries. Since these MNEs control the functional division of labour throughout the value chain (Dallas et al., 2019), they can potentially provide their local affiliates with the strategic resources and knowledge needed to engage in innovation in the domestic markets (Lema et al., 2019). Therefore, knowledge transfer within the Global Value Chains (GVCs) is an important channel, possibly driving the diffusion of international low-carbon technologies, and overcoming the lack of knowledge and technology, which is often reported as a key barrier to achieving the green energy transition, especially in less developed countries (IRENA, 2017).

The paper by Amendolagine et al., 2023 provide new insights on how foreign investments in green technologies can contribute to greening the host countries. Following the conceptual framework illustrated in Figure 1, the research explores to what extent foreign direct investments (FDIs) in renewable energy technologies, contribute to the increase in the green innovative capabilities of their subsidiaries vis-à-vis domestic companies. Three key moderating factors are investigated: a) host country characteristics, accounting for differences among countries at different levels of economic development (Awijen et al., 2022; Noailly and Ryfisch, 2015); b) technology specificity, exploring the differences between solar PV and wind (Binz and Truffer, 2017; Quitzow et al., 2017); c) MNE entry mode, distinguishing between greenfield investments and acquisitions (Amendolagine et al., 2021).

The empirical analysis draws on a database of 1,055 subsidiaries of green FDIs undertaken from 2003 to 2015 and a counterfactual sample of domestic green companies, which are neither investor nor subsidiary, with at least one patent in renewable energy technologies. The green investments are distributed across countries at different levels of development, with about one fourth of the subsidiaries located in middle-income host countries according to the World Bank’s classification.

The first interesting finding is that subsidiaries of green MNEs are more innovative than locally owned firms with similar characteristics, implying that foreign ownership positively impacts on the companies’ innovative capabilities. The second, very relevant from the policy point view, finding is that the green innovative advantage vis-à-vis domestic companies is larger in less developed countries, especially if they already possess higher levels of relevant domestic innovative activity, as exemplified by the cases of China and India. Furthermore, our sectoral analysis suggests that green FDI is more effective in spurring innovation when technologies are characterized by low tradability and a large component of doing, using, and interacting (DUI) involved in knowledge production, as in wind turbines compared to solar PV industries. Finally, cross-border acquisitions are more efficient at establishing green innovative capabilities than newly established greenfield subsidiaries, since they can rely on more local embeddedness.

Two key policy implications can be drawn from these findings. National policymakers should focus on attracting foreign investment in green technology sectors to boost local innovation, allowing for adaptation to local needs and the creation of new global green solutions. In the Global South, policymakers should view the role of MNEs more as a potential source of (green) industrial development than as a source of exploitation. Moreover, knowledge and technology spillover from MNE subsidiaries to domestic companies should be supported with policies including local content requirements and training of the local workforce, aiming at strengthening green innovative capabilities in the host countries.

There is also a key role to play for international organizations in strengthening green innovation systems. Increases in green innovative capacity benefit the global green transition and promote more technological variety in the market (that is, reducing the control of green technologies by a few advanced lead markets).

It is high time that the issue of green technology transfers takes a more central role in the World Trade Organization around the TRIMS agreement so that policy frameworks reflect the public goods nature of green technology and support the global diffusion of green technology through FDIs. Intellectual property and GVCs for renewable energy technology are mainly concentrated in a handful of advanced countries: more international efforts are needed to globalize and speed up the green transformation. There is a mounting consensus regarding the need to treat green technologies, especially in renewable energy, as essential global public goods (United Nations, 2022).

Furthermore, international organizations such as the United Nations Framework Convention on Climate Change (UNFCCC) should focus more on the importance of FDI as an important channel for low-carbon technology transfers. In the technology needs assessments undertaken under the UNFCCC in various countries with the aim of identifying specific green technologies of relevance, there should be greater focus on the importance of enabling countries to attract FDIs as mechanisms for technology transfer.

Finally, research on GVCs has started to focus more on the environmental sustainability of value chains, often in relation to industries with a large negative impact, such as garments, and the role of lead firms in pushing their upstream suppliers to improve their environmental performance. The paper’s findings show the importance of studying industries that are ‘born green’ and how lead firms though their ever-expanding GVCs can influence the green transition at a global scale.

The first interesting finding is that subsidiaries of green MNEs are more innovative than locally owned firms with similar characteristics, implying that foreign ownership positively impacts on the companies’ innovative capabilities. The second, very relevant from the policy point view, finding is that the green innovative advantage vis-à-vis domestic companies is larger in less developed countries, especially if they already possess higher levels of relevant domestic innovative activity, as exemplified by the cases of China and India. Furthermore, our sectoral analysis suggests that green FDI is more effective in spurring innovation when technologies are characterized by low tradability and a large component of doing, using, and interacting (DUI) involved in knowledge production, as in wind turbines compared to solar PV industries. Finally, cross-border acquisitions are more efficient at establishing green innovative capabilities than newly established greenfield subsidiaries, since they can rely on more local embeddedness.

Two key policy implications can be drawn from these findings. National policymakers should focus on attracting foreign investment in green technology sectors to boost local innovation, allowing for adaptation to local needs and the creation of new global green solutions. In the Global South, policymakers should view the role of MNEs more as a potential source of (green) industrial development than as a source of exploitation. Moreover, knowledge and technology spillover from MNE subsidiaries to domestic companies should be supported with policies including local content requirements and training of the local workforce, aiming at strengthening green innovative capabilities in the host countries.

There is also a key role to play for international organizations in strengthening green innovation systems. Increases in green innovative capacity benefit the global green transition and promote more technological variety in the market (that is, reducing the control of green technologies by a few advanced lead markets).

It is high time that the issue of green technology transfers takes a more central role in the World Trade Organization around the TRIMS agreement so that policy frameworks reflect the public goods nature of green technology and support the global diffusion of green technology through FDIs. Intellectual property and GVCs for renewable energy technology are mainly concentrated in a handful of advanced countries: more international efforts are needed to globalize and speed up the green transformation. There is a mounting consensus regarding the need to treat green technologies, especially in renewable energy, as essential global public goods (United Nations, 2022).

Furthermore, international organizations such as the United Nations Framework Convention on Climate Change (UNFCCC) should focus more on the importance of FDI as an important channel for low-carbon technology transfers. In the technology needs assessments undertaken under the UNFCCC in various countries with the aim of identifying specific green technologies of relevance, there should be greater focus on the importance of enabling countries to attract FDIs as mechanisms for technology transfer.

Finally, research on GVCs has started to focus more on the environmental sustainability of value chains, often in relation to industries with a large negative impact, such as garments, and the role of lead firms in pushing their upstream suppliers to improve their environmental performance. The paper’s findings show the importance of studying industries that are ‘born green’ and how lead firms though their ever-expanding GVCs can influence the green transition at a global scale.

References

Amendolagine, V., Hansen, U. E., Lema, R., Rabellotti, R., & Ribaudo, D. (2023). Do green foreign direct investments increase the innovative capability of MNE subsidiaries?. World Development, 170, 106342.

Amendolagine, V., Lema, R., & Rabellotti, R. (2021). Green foreign direct investments and the deepening of capabilities for sustainable innovation in multinationals: Insights from renewable energy. Journal of Cleaner Production, 310, 127381.

Awijen, H., Belaïd, F., Zaied, Y. B., Hussain, N., & Lahouel, B. B. (2022). Renewable energy deployment in the MENA region: Does innovation matter? Technological Forecasting and Social Change, 179, 121633.

Binz, C., & Truffer, B. (2017). Global Innovation Systems – A conceptual framework for innovation dynamics in transnational contexts. Research Policy, 46(7), 1284–1298.

Dallas, M. P., Ponte, S., & Sturgeon, T. J. (2019). Power in global value chains. Review of International Political Economy, 26(4), 666–694.

IEA (2018). World energy outlook. International Energy Agency (IEA), Paris.

IRENA (2017). Accelerating the Energy Transition through Innovation, International Renewable Energy Agency (IRENA), Abu Dhabi.

IRENA and ADFD (2020). Advancing renewables in developing countries: Progress of projects supported through the IRENA/ADFD Project Facility, International Renewable Energy Agency (IRENA) and Abu Dhabi Fund for Development (ADFD), Abu Dhabi.

Lema, R., Fu, X., & Rabellotti, R. (2020). Green windows of opportunity: latecomer development in the age of transformation toward sustainability. Industrial and Corporate Change, 29(5), 1193–1209.

Noailly, J., & Ryfisch, D. (2015). Multinational firms and the internationalization of green R&D: A review of the evidence and policy implications. Energy Policy, 83, 218–228.

Pegels, A., & Altenburg, T. (2020). Latecomer development in a “greening” world: Introduction to the Special Issue. World Development, 135, 105084.

Quitzow, R., Huenteler, J., & Asmussen, H. (2017). Development trajectories in China’s wind and solar energy industries: How technology-related differences shape the dynamics of industry localization and catching up. Journal of Cleaner Production, 158, 122–133.

UNCTAD (2023). Opening green windows. Technological opportunities for a low-carbon world, Technology and Innovation Report 2023, March, Geneva.

United Nations (2022). ‘Lifeline’ of renewable energy can steer world out of climate crisis: UN chief, UN News Global Perspective Human Stories, May 18, New York.

Amendolagine, V., Hansen, U. E., Lema, R., Rabellotti, R., & Ribaudo, D. (2023). Do green foreign direct investments increase the innovative capability of MNE subsidiaries?. World Development, 170, 106342.

Amendolagine, V., Lema, R., & Rabellotti, R. (2021). Green foreign direct investments and the deepening of capabilities for sustainable innovation in multinationals: Insights from renewable energy. Journal of Cleaner Production, 310, 127381.

Awijen, H., Belaïd, F., Zaied, Y. B., Hussain, N., & Lahouel, B. B. (2022). Renewable energy deployment in the MENA region: Does innovation matter? Technological Forecasting and Social Change, 179, 121633.

Binz, C., & Truffer, B. (2017). Global Innovation Systems – A conceptual framework for innovation dynamics in transnational contexts. Research Policy, 46(7), 1284–1298.

Dallas, M. P., Ponte, S., & Sturgeon, T. J. (2019). Power in global value chains. Review of International Political Economy, 26(4), 666–694.

IEA (2018). World energy outlook. International Energy Agency (IEA), Paris.

IRENA (2017). Accelerating the Energy Transition through Innovation, International Renewable Energy Agency (IRENA), Abu Dhabi.

IRENA and ADFD (2020). Advancing renewables in developing countries: Progress of projects supported through the IRENA/ADFD Project Facility, International Renewable Energy Agency (IRENA) and Abu Dhabi Fund for Development (ADFD), Abu Dhabi.

Lema, R., Fu, X., & Rabellotti, R. (2020). Green windows of opportunity: latecomer development in the age of transformation toward sustainability. Industrial and Corporate Change, 29(5), 1193–1209.

Noailly, J., & Ryfisch, D. (2015). Multinational firms and the internationalization of green R&D: A review of the evidence and policy implications. Energy Policy, 83, 218–228.

Pegels, A., & Altenburg, T. (2020). Latecomer development in a “greening” world: Introduction to the Special Issue. World Development, 135, 105084.

Quitzow, R., Huenteler, J., & Asmussen, H. (2017). Development trajectories in China’s wind and solar energy industries: How technology-related differences shape the dynamics of industry localization and catching up. Journal of Cleaner Production, 158, 122–133.

UNCTAD (2023). Opening green windows. Technological opportunities for a low-carbon world, Technology and Innovation Report 2023, March, Geneva.

United Nations (2022). ‘Lifeline’ of renewable energy can steer world out of climate crisis: UN chief, UN News Global Perspective Human Stories, May 18, New York.