Integration in global IT value chains does not necessarily improve innovation capacity

Rasmus Lema, Carlo Pietrobelli, Roberta Rabellotti, Antonio Vezzani

Jul, 2024

#Trade and FDI

#Manufacturing

#Services

#East Asia and Pacific

#EU / Western Europe

#North America

Global Value Chains (GVC) have characterized the evolution of the global economy during the last three decades. Integration in GVC offers remarkable potential for international tasks specialization and for accessing key knowledge and technology. Yet, it is less clear whether and under which circumstances countries and firms are able to acquire innovation capacities.

Whether this is possible or not depends on the techno-economic characteristics of the sector considered and on countries’ contextual factors. In this blog post, based on Lema et al. (2021), we use empirical evidence on 45 countries around the world to investigate the building up of innovation capacities in the Information Technology industry (IT), distinguishing between the ‘Computer, electronics and optical products’ (hardware) and the ‘IT and other information services’ (software) sectors.

Whether this is possible or not depends on the techno-economic characteristics of the sector considered and on countries’ contextual factors. In this blog post, based on Lema et al. (2021), we use empirical evidence on 45 countries around the world to investigate the building up of innovation capacities in the Information Technology industry (IT), distinguishing between the ‘Computer, electronics and optical products’ (hardware) and the ‘IT and other information services’ (software) sectors.

GVC participation & innovation in IT sectors

Both the hardware and the software sectors are highly innovative and deeply influenced by GVC trade. About 40% of R&D investments by the top R&D investing companies worldwide are performed in the IT industry (Grassano et al., 2020). Furthermore, the spread of digital technologies, together with the reduction in transport and communication costs, has favoured the reorganization of international production and business models and the rise of GVCs (UNCTAD, 2020).

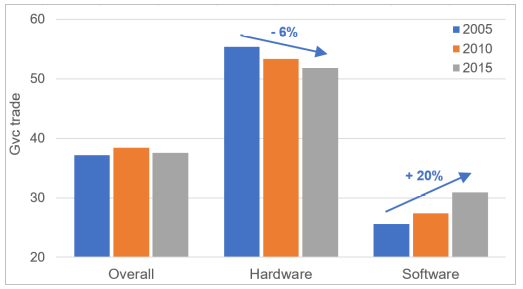

In 2005, GVC trade in the hardware sector was particularly high, while that in software was rather low. Since then, the two sectors have been moving in opposite directions: GVC participation has decreased in hardware (-6% between 2005 and 2015) and strongly increased in software (+20%).

Similarly, differences in innovation capacity across the two sectors have been especially marked. In terms of patents filed at the United States Patent and Trademark Office (USPTO) in 2015, those related to technologies pertaining to the hardware sector where much more prominent than those related to the software sector (44% vs 2.4%). However, between 2005 and 2015, patents related to the software sector almost doubled (+90%), experiencing a much higher growth rate than the hardware sector (+26%), albeit from a much lower base.

In 2005, GVC trade in the hardware sector was particularly high, while that in software was rather low. Since then, the two sectors have been moving in opposite directions: GVC participation has decreased in hardware (-6% between 2005 and 2015) and strongly increased in software (+20%).

Similarly, differences in innovation capacity across the two sectors have been especially marked. In terms of patents filed at the United States Patent and Trademark Office (USPTO) in 2015, those related to technologies pertaining to the hardware sector where much more prominent than those related to the software sector (44% vs 2.4%). However, between 2005 and 2015, patents related to the software sector almost doubled (+90%), experiencing a much higher growth rate than the hardware sector (+26%), albeit from a much lower base.

Figure 1: GVC trade: total and in IT industries

Note: Share of trade in intermediaries over total trade.

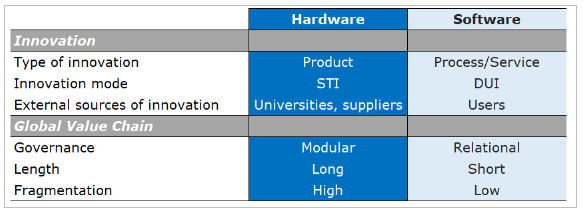

What explains these differences between hardware and software sectors?

The hardware and software sectors are very different in terms of the prevailing characteristics of innovation and GVC integration (Figure 2). The hardware sector is largely characterized by product innovation based on codified scientific and technical knowledge, which can be globally accessed to solve local problems. The codification of knowledge enables firms to innovate regardless of their GVC position. The possibility to codify specifications and the modularity of products allow for an independent development and production of specific components. Codification and standardization thus reduce asset specificity and the need of the buyer to directly control and interact with its suppliers.

The software sector, in contrast, is characterized by the acquisition of tacit knowledge based on learning and experience and requiring a strong interdependence with users. As a result, GVCs are characterized by complex (relational) interactions among players that can create mutual dependences and dense exchanges of knowledge prevail.

The software sector, in contrast, is characterized by the acquisition of tacit knowledge based on learning and experience and requiring a strong interdependence with users. As a result, GVCs are characterized by complex (relational) interactions among players that can create mutual dependences and dense exchanges of knowledge prevail.

GVC & innovation trajectories in the IT

Based on an industry-country level dataset combining information from the Trade in Value Added (TiVA) database produced by the OECD and USPTO which provides information on patents, Lema et al. (2021) reach the following main findings:

1. Countries with initially well-developed innovation capacity experience a greater increase in patenting activity, hinting to a strong cumulativeness of the innovation process in the IT industry. This also implies that countries lacking such initial capabilities find it more difficult to catch up with international leaders. In other words, IT industries benefit from increasing knowledge returns to innovation.

2. In the hardware sector, an increased innovation capacity is associated with a decreased GVC participation. This can be explained by the ability to codify and separate production from innovation in this sector. Deepening of innovative capacities thus depends less on integration into GVCs and de-globalization (reshoring) has few implications for continued innovative capacity. Conversely, suppliers may move deeper into GVCs without gaining significant access to critical tacit knowledge.

3. In the software sector, in contrast, the strengthening of innovation capacity is significantly correlated with increased participation in GVCs. This can be explained by the continued dependence on user-producer interaction for innovation in the software and IT-enabled services sector.

4. Some countries (i.e. Finland, Israel, South Korea and USA) are able to leverage synergies between hardware and software and appear among the most dynamic in both sectors. Therefore, dynamism in hardware may be fostered by a dynamic software sector, and vice versa.

1. Countries with initially well-developed innovation capacity experience a greater increase in patenting activity, hinting to a strong cumulativeness of the innovation process in the IT industry. This also implies that countries lacking such initial capabilities find it more difficult to catch up with international leaders. In other words, IT industries benefit from increasing knowledge returns to innovation.

2. In the hardware sector, an increased innovation capacity is associated with a decreased GVC participation. This can be explained by the ability to codify and separate production from innovation in this sector. Deepening of innovative capacities thus depends less on integration into GVCs and de-globalization (reshoring) has few implications for continued innovative capacity. Conversely, suppliers may move deeper into GVCs without gaining significant access to critical tacit knowledge.

3. In the software sector, in contrast, the strengthening of innovation capacity is significantly correlated with increased participation in GVCs. This can be explained by the continued dependence on user-producer interaction for innovation in the software and IT-enabled services sector.

4. Some countries (i.e. Finland, Israel, South Korea and USA) are able to leverage synergies between hardware and software and appear among the most dynamic in both sectors. Therefore, dynamism in hardware may be fostered by a dynamic software sector, and vice versa.

Figure 2: Hardware and Software characteristics

Note: STI: Scientific and Technological-based Innovation; DUI: Learning by Doing, Using and Interacting

Conclusion

IT industries are characterized by strong cumulativeness in the innovation process that may lead to an increasing concentration in innovation capacity in a handful of countries. Indeed, our evidence shows that leading countries in the IT industry have strengthened their innovation capacity with respect to others, calling for some reflection on the possible effects on the worldwide catching-up process.

However, hardware and software sectors are characterized by differences in the way GVCs and the innovation process are structured. In general, only in the software sector GVC participation and strengthening of the innovation capacity seem to go hand in hand. The increasing relevance of GVC trade in software calls for a better understanding of the GVC-innovation linkages in knowledge intensive business services.

Some countries have been able to reinforce their innovation capacity both in the hardware and software sectors, suggesting that they may be in a better position to leverage the complementarities deriving from the recombination of hardware and software triggered by platforms and industry 4.0 technologies. National systems of innovation do not seem to have the same capacity to foster and exploit these synergies. A finer-grained analysis to understand the synergies (or lack of them) among different subsystems is needed. New unexpected windows of opportunity may be opening from the development and integration of physical and virtual systems. Our findings suggest that strong innovators have been more successful in integrating hardware and software capacities, possibly because they enjoy key ownership stakes in platforms, giving access and capability to leverage knowledge and orchestrate innovation networks (Sturgeon 2021).

The GVC-innovation link is not straightforward, as it is sometimes assumed. There is a vast literature showing a strong positive correlation between GVC participation and innovation (e.g. Tajoli and Felice 2018), but as we show in our study, there are important exceptions. The plurality of patterns observed, reflecting a complex and dynamic relationship between GVC participation and innovation, calls for further research to understand the role of specific factors that may lead to successes or failures in global knowledge intensive industries.

However, hardware and software sectors are characterized by differences in the way GVCs and the innovation process are structured. In general, only in the software sector GVC participation and strengthening of the innovation capacity seem to go hand in hand. The increasing relevance of GVC trade in software calls for a better understanding of the GVC-innovation linkages in knowledge intensive business services.

Some countries have been able to reinforce their innovation capacity both in the hardware and software sectors, suggesting that they may be in a better position to leverage the complementarities deriving from the recombination of hardware and software triggered by platforms and industry 4.0 technologies. National systems of innovation do not seem to have the same capacity to foster and exploit these synergies. A finer-grained analysis to understand the synergies (or lack of them) among different subsystems is needed. New unexpected windows of opportunity may be opening from the development and integration of physical and virtual systems. Our findings suggest that strong innovators have been more successful in integrating hardware and software capacities, possibly because they enjoy key ownership stakes in platforms, giving access and capability to leverage knowledge and orchestrate innovation networks (Sturgeon 2021).

The GVC-innovation link is not straightforward, as it is sometimes assumed. There is a vast literature showing a strong positive correlation between GVC participation and innovation (e.g. Tajoli and Felice 2018), but as we show in our study, there are important exceptions. The plurality of patterns observed, reflecting a complex and dynamic relationship between GVC participation and innovation, calls for further research to understand the role of specific factors that may lead to successes or failures in global knowledge intensive industries.

References

Castellacci, F. (2008). Technological paradigms, regimes and trajectories: Manufacturing and service industries in a new taxonomy of sectoral patterns of innovation. Research Policy, 37(6–7), 978–994.

Grassano, N., Hernandez Guevara, H., Tuebke, A., Amoroso, S., Dosso, M., Georgakaki, A., & Pasimeni, F. (2020). The 2020 EU Industrial R&D Investment Scoreboard. Publications Office of the European Union, Luxembourg.

Lema, R., Pietrobelli, C., Rabellotti, R., & Vezzani, A., (2021). Deepening or delinking? Innovative capacity and global value chain participation in the ICT sectors. UNU-MERIT Working Paper # 2021-007, Maastricht.

Sturgeon, T. J. (2021). Upgrading strategies for the digital economy. Global Strategy Journal, 1(1), 34-57.

Tajoli, L., & Felice, G. (2018). Global value chains participation and knowledge spillovers in developed and developing countries: An empirical investigation. The European Journal of Development Research, 30(3), 505-532.

UNCTAD (2020). World Investment Report 2020. United Nations Conference on Trade and Development, Geneva.

Castellacci, F. (2008). Technological paradigms, regimes and trajectories: Manufacturing and service industries in a new taxonomy of sectoral patterns of innovation. Research Policy, 37(6–7), 978–994.

Grassano, N., Hernandez Guevara, H., Tuebke, A., Amoroso, S., Dosso, M., Georgakaki, A., & Pasimeni, F. (2020). The 2020 EU Industrial R&D Investment Scoreboard. Publications Office of the European Union, Luxembourg.

Lema, R., Pietrobelli, C., Rabellotti, R., & Vezzani, A., (2021). Deepening or delinking? Innovative capacity and global value chain participation in the ICT sectors. UNU-MERIT Working Paper # 2021-007, Maastricht.

Sturgeon, T. J. (2021). Upgrading strategies for the digital economy. Global Strategy Journal, 1(1), 34-57.

Tajoli, L., & Felice, G. (2018). Global value chains participation and knowledge spillovers in developed and developing countries: An empirical investigation. The European Journal of Development Research, 30(3), 505-532.

UNCTAD (2020). World Investment Report 2020. United Nations Conference on Trade and Development, Geneva.