Can Central and Eastern European countries ‘smile’ more? Trade patterns through the lens of value chain functions

Aleksandra Kordalska & Magdalena Olczyk

Jul, 2024

#Trade and FDI

#Manufacturing

#Services

#EU / Western Europe

#Eastern/Non-EU Europe and Central Asia

A key question in the context of global value chains is: How can countries upgrade their position and focus more on high value-added activities in global value chains (GVCs)? This blog focuses on selected Central and Eastern European (CEE) countries – the Czech Republic, Estonia, Hungary, Latvia, Lithuania, Poland, Slovakia, and Slovenia – and looks at their functional specialization profiles and changes in these profiles, together with crucial factors that could enable them to upgrade their positions in GVCs. Our analysis concentrates on these countries, as they are relatively homogeneous economies with similar transformation paths, strong trade relations with larger EU economies (such as Germany), and relatively high shares of industrial production in their GDPs.

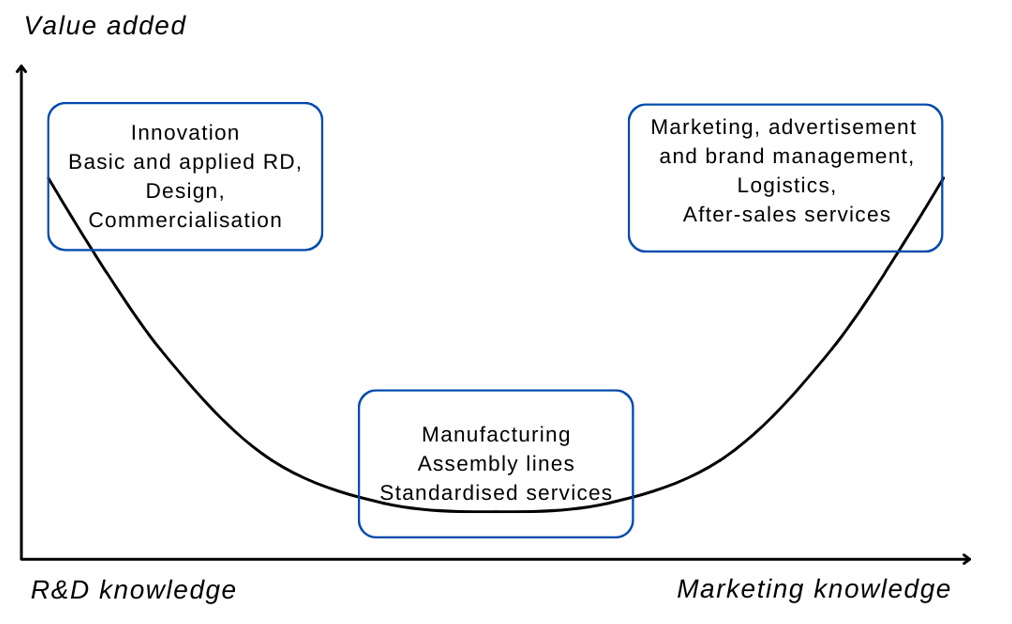

Who benefits from participation in global value chains? A smile curve

The vast majority of world trade is increasingly organized within GVCs, along which goods and services are produced by different companies in different places and cross borders many times (World Bank 2019). Thanks to Koopman et al.’s (2014) accounting framework, which allows us to break down a country's gross exports into different value-added components, we can estimate how much each country adds to the value of a product in the process of producing it (known as domestic value added). Unfortunately, the benefits from participating in GVCs are unequally distributed among the different participants and the gains appear to be more significant for middle- and high-income countries (Ignatenko et al., 2019). This is illustrated by the smile curve (Figure 1), which was first proposed by Shih (1996), the founder of Acer, who discovered that the two ends of the value chain generate higher value-added than the middle part. High value-added service activities and/or business functions at the beginning and end of the smile curve tend to be located in developed countries (so-called headquarter economies) while pure production activities are located in developing and emerging economies (so-called factory economies).

Figure 1. The smile curve

How can countries create more value from trade in GVCs and how is it measured?

According to the concept of the smile curve, countries should specialize in activities that create more value added along GVCs. The most popular metric of trade specialization is the Revealed Comparative Advantage (RCA) Index. The most common formula for calculating the RCA index is that proposed by Balassa (1965): a country has a comparative advantage for a given product if the share of that product in the country's exports is larger than its share in the exports of a given trade area (a specific region or the world). A country has a comparative advantage if its RCA value is greater than one and a comparative “disadvantage” if it is smaller than one.

However, the smile curve shows that a country's ability to compete internationally in GVCs crucially depends on activities or business functions within industries, and not anymore on competition between entire industries or products. This is why Timmer et al. (2019) propose a new measure of specialization, which they term functional. Functional specialization is based on Balassa's RCA formula but focuses on value chain activities by considering the occupations of the workers who carry out these activities. Stöllinger (2021) provides a different way to measure functional specialization. He also uses Balassa’s formula but focuses on business activities offshored by firms via FDI. These two approaches allow us to calculate and evaluate the comparative advantages of countries for business functions in GVCs.

However, the smile curve shows that a country's ability to compete internationally in GVCs crucially depends on activities or business functions within industries, and not anymore on competition between entire industries or products. This is why Timmer et al. (2019) propose a new measure of specialization, which they term functional. Functional specialization is based on Balassa's RCA formula but focuses on value chain activities by considering the occupations of the workers who carry out these activities. Stöllinger (2021) provides a different way to measure functional specialization. He also uses Balassa’s formula but focuses on business activities offshored by firms via FDI. These two approaches allow us to calculate and evaluate the comparative advantages of countries for business functions in GVCs.

Functional specialization pattern in CEE economies: a functional trap?

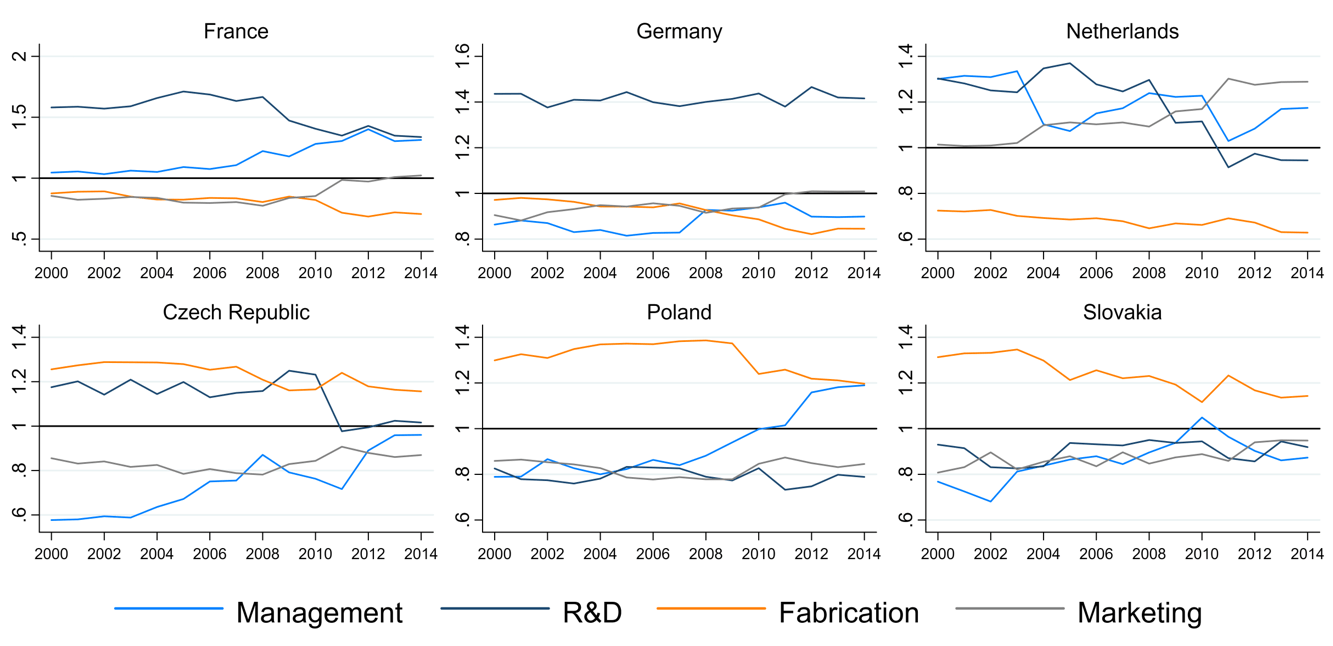

Our analysis of functional specialization patterns in CEE countries reveals crucial discrepancies between the EU-15 and CEE countries with a dominance of pre- and post-production functions in the EU-15 and a significant concentration of fabrication functions in the CEE countries (Figure 2). This specialization profile of the CEE countries suggests that these may have been stuck in a functional specialization trap (Kordalska and Olczyk, 2022). This applies particularly to Slovakia and Poland. For the Baltic States, in addition to comparative advantages in fabrication, advantages in marketing services are observed. A new research report assessing functional specialization in EU value chains in the period 2003-2021 from an international trade perspective but also from a greenfield FDI project perspective confirms these results (Kordalska et al., 2022).

Figure 2. Functional specialization – RCA index, selected EU-15 countries vs. CEE countries, 2000-2014

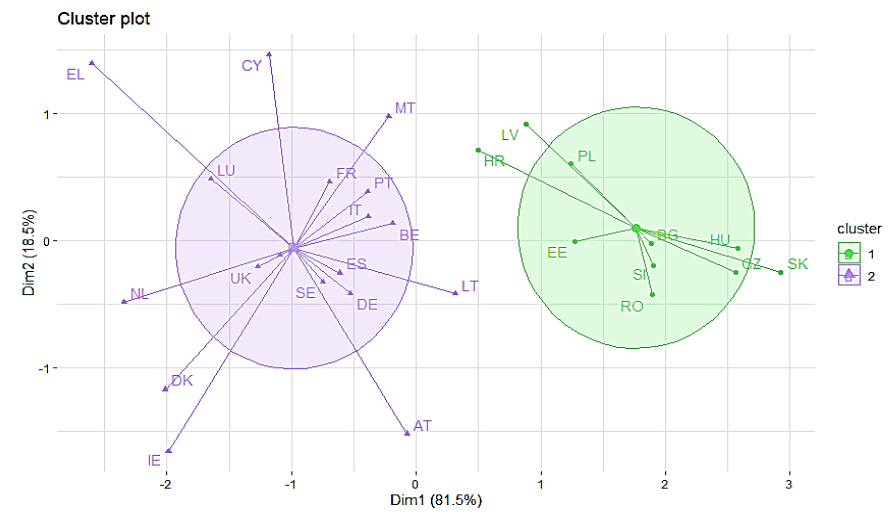

The findings in the report also suggest that a duality of “factory” and “headquarter” economies persists in the EU28 countries. We use cluster analysis to classify the UE economies in homogeneous groups based on their pre-fabrication, fabrication and post-fabrication specialization values. Cluster analysis based on the similarity algorithm aims at sorting different objects into groups in such a way as to the degree of association between two objects is maximal if they belong to the same group, and minimal otherwise. The hypothesis that the EU28 countries are divided in two clusters – i.e. headquarter economies and factory economies – is still valid, and the dividing line largely coincides with the division between old and new EU countries (Figure 3).

Cluster 1 only contains countries that joined the EU after 2004 and which have a comparative advantage exclusively in fabrication activity. Cluster 2 contains 18 countries: the EU15 and three countries that joined the EU in 2004, namely Cyprus, Malta and Lithuania, which have comparative advantages in pre- and post-production activities (Kordalska et al., 2022).

Despite the ongoing unfavorable functional specialization patterns in the CEE countries compared to the other EU countries, we observe tendencies towards decreasing shares of the fabrication function and a growing importance of pre- and post-fabrication functions, particularly marketing and R&D activities (ibid).

Cluster 1 only contains countries that joined the EU after 2004 and which have a comparative advantage exclusively in fabrication activity. Cluster 2 contains 18 countries: the EU15 and three countries that joined the EU in 2004, namely Cyprus, Malta and Lithuania, which have comparative advantages in pre- and post-production activities (Kordalska et al., 2022).

Despite the ongoing unfavorable functional specialization patterns in the CEE countries compared to the other EU countries, we observe tendencies towards decreasing shares of the fabrication function and a growing importance of pre- and post-fabrication functions, particularly marketing and R&D activities (ibid).

Figure 3. “Factory” and “headquarter” economies – the dichotomy between CEE and EU15 countries based on FDI data, 2003-2021

The determinants of upgrading CEE countries in GVCs

It is important to identify the factors that would enable the CEE economies to shift their activities along GVCs from lower-value-added functions (fabrication) to activities that add more value. Increasing their GDP per capita and decreasing economic distance from large economies like Germany (which plays the role of a hub in “Factory Europe”) could improve the CEE countries’ comparative advantage in R&D. Investment in human capital should be at the core of the CEE countries’ new policy to “climb up” the smile curve (Kordalska and Olczyk, 2022). A development model based on relatively high-skilled labor could allow some CEE countries to achieve specialization in management activities in GVCs. Estonia, Latvia, Lithuania, and Slovenia may in the future follow the paths of some Asian countries (such as Vietnam, the Philippines, and Malaysia), which reshaped their specialization profiles by transforming from giant assembly hubs for Japan and Korea into leading exporters of high technology intermediates (de Vries et al., 2019). Moreover, none of the CEE countries has a comparative advantage in activities closest to the consumer at the country level. Upgrading CEE countries’ positions in marketing activities would therefore require higher wages and stronger participation in activities at both ends of the “smile curve” (Kordalska and Olczyk, 2022).

Conclusions and outlook

The above analysis aims at a better understanding of the involvement of CEE countries in GVCs. Our objective is to highlight dualism – or functional clubs – within the EU: on the one hand, CEE countries are particularly specialized in the fabrication stage (factory economies), and, on the other hand, Western EU countries are mainly involved in pre- and post-fabrication activities (headquarter economies).

Functional specialization in fabrication has been a success model for CEE economies in the previous years. However, the coming years carry numerous challenges for the region. These include the need to adapt to new environmental regulations, to keep pace with the increasing digitalization of production, and to adapt to technological breakthroughs in the manufacturing sector. While these ‘megatrends’ could create opportunities for the region to upgrade and thrive, they could also undermine the regions success if not adequately addressed. In light of new these challenges, the previous successful catch-up process of the CEE countries based on their role as factory economies might not be sustainable (Grieveson et al. 2021).

A set of policies are therefore required to continue supporting the engagement of the CEE economies in GVCs and to maximize these countries’ potential to upgrade their business functions along the ‘smile curve’. First, CEE countries should focus on structural reforms targeting economic growth and create additional resources to reduce their ‘economic distance’ to the EU (Kordalska, Olczyk 2022). Second, higher per-capita income should be coupled with more efficient institutions that foster skill building, innovation, and efficient access to capital to increase domestic labor productivity (World Bank 2017). Removing existing barriers to R&D, improving the allocation of R&D spending to domestic enterprises (instead of allocating most R&D spending directly to multinational enterprises), reforming the relatively underdeveloped National Innovation System (NIS), and tailoring industrial policies to attract investments in knowledge-intensive segments of the value chain are fundamental components of a successful functional upgrade strategy. Finally, we hope that these findings would serve as a guidepost for countries beyond CEE that want to move up the value chain from assembly centers to leading exporters of high value-added intermediate or final products.

Functional specialization in fabrication has been a success model for CEE economies in the previous years. However, the coming years carry numerous challenges for the region. These include the need to adapt to new environmental regulations, to keep pace with the increasing digitalization of production, and to adapt to technological breakthroughs in the manufacturing sector. While these ‘megatrends’ could create opportunities for the region to upgrade and thrive, they could also undermine the regions success if not adequately addressed. In light of new these challenges, the previous successful catch-up process of the CEE countries based on their role as factory economies might not be sustainable (Grieveson et al. 2021).

A set of policies are therefore required to continue supporting the engagement of the CEE economies in GVCs and to maximize these countries’ potential to upgrade their business functions along the ‘smile curve’. First, CEE countries should focus on structural reforms targeting economic growth and create additional resources to reduce their ‘economic distance’ to the EU (Kordalska, Olczyk 2022). Second, higher per-capita income should be coupled with more efficient institutions that foster skill building, innovation, and efficient access to capital to increase domestic labor productivity (World Bank 2017). Removing existing barriers to R&D, improving the allocation of R&D spending to domestic enterprises (instead of allocating most R&D spending directly to multinational enterprises), reforming the relatively underdeveloped National Innovation System (NIS), and tailoring industrial policies to attract investments in knowledge-intensive segments of the value chain are fundamental components of a successful functional upgrade strategy. Finally, we hope that these findings would serve as a guidepost for countries beyond CEE that want to move up the value chain from assembly centers to leading exporters of high value-added intermediate or final products.

References

Balassa, B. (1965). Trade Liberalisation and “Revealed” Comparative Advantage. Manchester School of Economic and Social Studies, 33(2), 99-123.

de Vries, G., Chen, Q., Hasan, R. & Li, Z. (2019). Do Asian Countries Upgrade in Global Value Chains? A Novel Approach and Empirical Evidence. Asian Economic Journal, 33(1), 13-37. https://doi.org/10.1111/asej.12166.

Grieveson, R., Bykova, A., Hanzl-Weiss, D., Hunya, G., Korpar, N., Podkaminer, L., ... & Stöllinger, R. (2021). Avoiding a trap and embracing the megatrends: Proposals for a new growth model in EU-CEE (No. 458). The Vienna Institute for International Economic Studies (wiiw).

Ignatenko, A., Raei, M. & Mircheva, M. (2019). Global Value Chains: What are the Benefits and Why Do Countries Participate? IMF Working Paper, WP/19/18, 1-22.

Koopman, R., Wang, Z. & Wei, S. (2014). Tracing Value-Added and Double Counting in Gross Exports. American Economic Review, 104(2), 459-494.

Kordalska, A., & Olczyk, M. (2022). Upgrading low value-added activities in global value chains: a functional specialisation approach. Economic Systems Research, 1-27. https://doi.org/10.1080/09535314.2022.2047011

Kordalska, A., Olczyk, M., Stöllinger, R. & Zavarská, Z. (2022). Functional Specialisation in EU Value Chains: Methods for Identifying EU Countries’ Roles in International Production Networks (No. 461). The Vienna Institute for International Economic Studies (wiiw).

Shih, S. (1996). Me-Too is Not My Style: Challenge Difficulties, Breakthrough Bottlenecks, Create Value. Taipei: The Acer Foundation.

Stöllinger, R. (2021), Testing the Smile Curve: Functional Specialisation in GVCs and Value Creation, Structural Change and Economic Dynamics, 56, pp. 93-116.

Timmer, M.P., Miroudot, S. & de Vries, G.J. (2019), Functional specialisation in trade, Journal of Economic Geography, 19(1), pp. 1-30.

World Bank. (2019). World Development Report 2020:Trading for Development in the Age of Global Value Chains. https://openknowledge.worldbank.org/handle/10986/32437

Ye, M., Meng, B., & Wei, S. J. (2015). Measuring smile curves in global value chains. Inst. of Developing Economies, Japan External Trade Organization.

Balassa, B. (1965). Trade Liberalisation and “Revealed” Comparative Advantage. Manchester School of Economic and Social Studies, 33(2), 99-123.

de Vries, G., Chen, Q., Hasan, R. & Li, Z. (2019). Do Asian Countries Upgrade in Global Value Chains? A Novel Approach and Empirical Evidence. Asian Economic Journal, 33(1), 13-37. https://doi.org/10.1111/asej.12166.

Grieveson, R., Bykova, A., Hanzl-Weiss, D., Hunya, G., Korpar, N., Podkaminer, L., ... & Stöllinger, R. (2021). Avoiding a trap and embracing the megatrends: Proposals for a new growth model in EU-CEE (No. 458). The Vienna Institute for International Economic Studies (wiiw).

Ignatenko, A., Raei, M. & Mircheva, M. (2019). Global Value Chains: What are the Benefits and Why Do Countries Participate? IMF Working Paper, WP/19/18, 1-22.

Koopman, R., Wang, Z. & Wei, S. (2014). Tracing Value-Added and Double Counting in Gross Exports. American Economic Review, 104(2), 459-494.

Kordalska, A., & Olczyk, M. (2022). Upgrading low value-added activities in global value chains: a functional specialisation approach. Economic Systems Research, 1-27. https://doi.org/10.1080/09535314.2022.2047011

Kordalska, A., Olczyk, M., Stöllinger, R. & Zavarská, Z. (2022). Functional Specialisation in EU Value Chains: Methods for Identifying EU Countries’ Roles in International Production Networks (No. 461). The Vienna Institute for International Economic Studies (wiiw).

Shih, S. (1996). Me-Too is Not My Style: Challenge Difficulties, Breakthrough Bottlenecks, Create Value. Taipei: The Acer Foundation.

Stöllinger, R. (2021), Testing the Smile Curve: Functional Specialisation in GVCs and Value Creation, Structural Change and Economic Dynamics, 56, pp. 93-116.

Timmer, M.P., Miroudot, S. & de Vries, G.J. (2019), Functional specialisation in trade, Journal of Economic Geography, 19(1), pp. 1-30.

World Bank. (2019). World Development Report 2020:Trading for Development in the Age of Global Value Chains. https://openknowledge.worldbank.org/handle/10986/32437

Ye, M., Meng, B., & Wei, S. J. (2015). Measuring smile curves in global value chains. Inst. of Developing Economies, Japan External Trade Organization.