What determines countries’ global value chain participation? Three lessons from the past that matter for the future of global value chains

Ana Margarida Fernandes, Hiau Looi Kee, and Deborah Winkler

Apr 19, 2024 06:40 AM

#Trade and FDI

#East Asia and Pacific

#EU / Western Europe

#Eastern/Non-EU Europe and Central Asia

Countries participate differently in global value chains

In the early 1990s, Argentina tried to develop a homegrown auto industry, hiding behind an average tariff of more than 13 percent. Over the past two decades, Argentina’s auto exports have stagnated at a dismal 0.2 percent of global auto exports.

Around the same period, General Motors (GM) set up GM Poland to import Opel cars for the large Polish domestic market. In 1994, production activities of GM Poland started, and today Poland is one of the world’s major auto exporting countries.

Similar to the auto industry in Poland, Vietnam’s electronics industry expanded sharply in less than a decade, fuelled by foreign direct investment (FDI). Today, Vietnam is the world’s second largest smartphone exporter, producing 40 percent of Samsung’s global mobile phone products and employing 35 percent of its global staff. A decade ago, Vietnam barely exported electronics products.

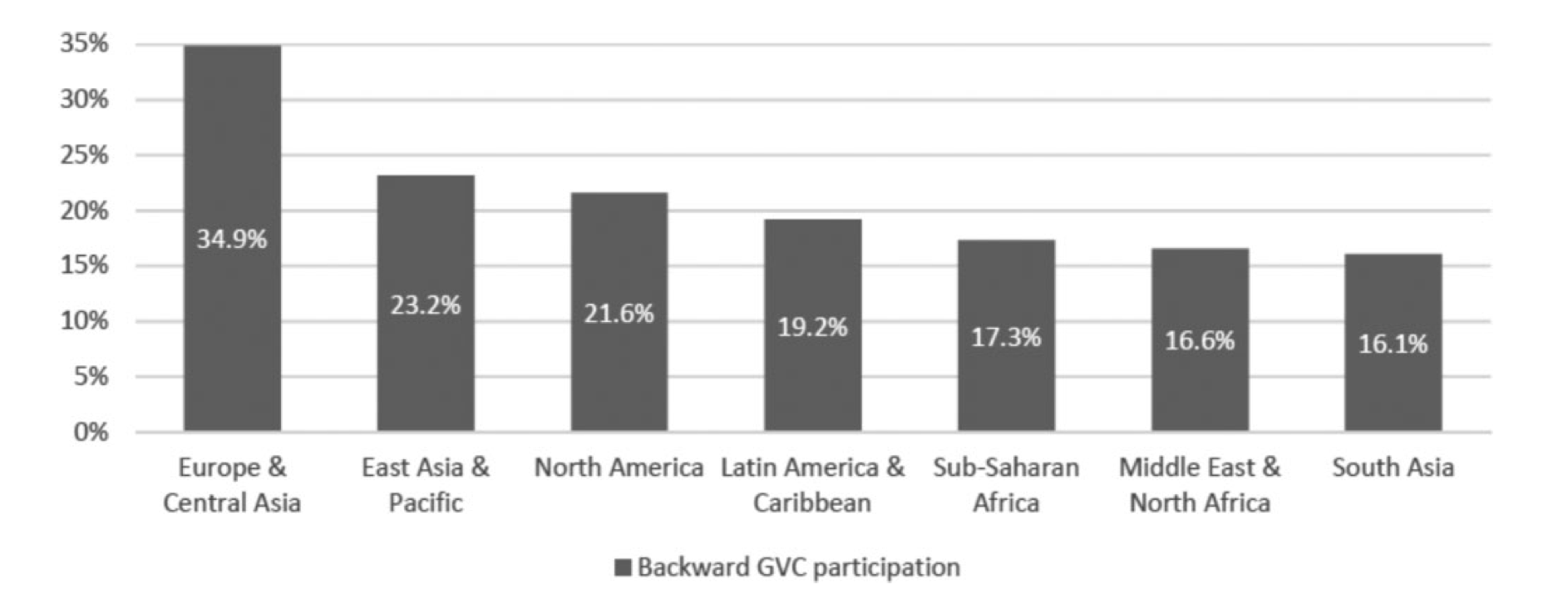

What sets Argentina, Poland, and Vietnam apart is their very different participation in global value chains (GVCs). In fact, the meteoric rises of Poland and Vietnam and the faltering of Argentina are not unique. China’s World Trade Organization (WTO) accession in 2001 ushered a new wave of GVCs which gave rise to “Factory Asia”1, while large parts of the Africa, South Asia, and Latin America regions are being left behind with little backward integration into GVCs (Figure 1). Backward GVC participation measures the import content of exports relative to total exports.2

Around the same period, General Motors (GM) set up GM Poland to import Opel cars for the large Polish domestic market. In 1994, production activities of GM Poland started, and today Poland is one of the world’s major auto exporting countries.

Similar to the auto industry in Poland, Vietnam’s electronics industry expanded sharply in less than a decade, fuelled by foreign direct investment (FDI). Today, Vietnam is the world’s second largest smartphone exporter, producing 40 percent of Samsung’s global mobile phone products and employing 35 percent of its global staff. A decade ago, Vietnam barely exported electronics products.

What sets Argentina, Poland, and Vietnam apart is their very different participation in global value chains (GVCs). In fact, the meteoric rises of Poland and Vietnam and the faltering of Argentina are not unique. China’s World Trade Organization (WTO) accession in 2001 ushered a new wave of GVCs which gave rise to “Factory Asia”1, while large parts of the Africa, South Asia, and Latin America regions are being left behind with little backward integration into GVCs (Figure 1). Backward GVC participation measures the import content of exports relative to total exports.2

Figure 1: Backward GVC participation varies across regions

At the heart of GVC participation are the international fragmentation of production across countries and durable firm-to-firm relationships that promote access to capital and inputs along production chains.3 The efficiency gains and technology diffusion within GVCs explain the boost to incomes and the reductions in poverty in the participating countries, as the examples of Bangladesh, China, and Vietnam illustrate.4 Empirical evidence across and within countries confirms that GVC participation fosters productivity, value-added, and growth.5

Given the positive developmental impacts of GVC participation, it is important to understand the factors that drive GVC participation.

Given the positive developmental impacts of GVC participation, it is important to understand the factors that drive GVC participation.

What factors determine backward GVC participation across countries?

Our forthcoming article6 in the World Bank Economic Review studies the determinants of backward GVC participation based on a panel dataset covering more than 100 countries over the past three decades. The time period reflects the growing international fragmentation of production. The diversity of countries in all geographical regions and at different stages of development makes the dataset uniquely suitable to estimate the relative importance of different determinants.

To address the challenges in establishing causality in a cross-country setting, we use both instrumental variables and difference-in-difference estimation approaches.7 We also undertake event studies to isolate the effects of trade and FDI liberalization episodes on GVC participation.

Our study finds that several factors increase backward GVC participation across countries, especially capital and skills factor endowments, smaller geographical distance to the GVC hubs (i.e., the distance to China, Germany and the United States), higher institutional quality, lower tariffs, and larger FDI inflows.8

Certain factors are shown to matter more strongly for GVC trade (i.e., trade flows by firms that use imported inputs for their exports) relative to traditional trade (i.e., trade flows by firms that only export but do not use imported inputs).

To address the challenges in establishing causality in a cross-country setting, we use both instrumental variables and difference-in-difference estimation approaches.7 We also undertake event studies to isolate the effects of trade and FDI liberalization episodes on GVC participation.

Our study finds that several factors increase backward GVC participation across countries, especially capital and skills factor endowments, smaller geographical distance to the GVC hubs (i.e., the distance to China, Germany and the United States), higher institutional quality, lower tariffs, and larger FDI inflows.8

Certain factors are shown to matter more strongly for GVC trade (i.e., trade flows by firms that use imported inputs for their exports) relative to traditional trade (i.e., trade flows by firms that only export but do not use imported inputs).

Three lessons from the past that matter for the future of global value chains

In the current wake of supply chain disruptions due to the COVID-19 pandemic, increasing protectionism, and rising nationalism across the globe, we highlight three key lessons from our analysis that will continue to matter for the future of GVCs:

1. Keeping trade costs low is key

Countries at a greater distance from GVC hubs face a higher level of trade frictions and therefore trade costs. Our analysis finds that a shorter distance to the GVC hubs – China, Germany, and the United States – is positively correlated with backward GVC participation.

Geography and thus trade costs are shown to affect GVC trade more strongly than traditional trade. There are several explanations. First, due to the larger number of trade links in a GVC, performance is determined by the strength of the weakest link in the supply chain.9 Second, trade costs affect not only prices of export goods, as is the case for traditional trade, but also those of imported inputs in a GVC.

In the context of the ongoing supply chain disruptions during the COVID-19 pandemic, characterized by increasing shipping prices and longer lead times, these considerations are critical. Higher trade costs will be factored into prices with negative consequences for final consumers. Going forward, it is key to strengthen the resilience of GVCs by improving trade facilitation and connectivity to keep trade costs low, which will be particularly beneficial to GVC participation in remote countries.

2. Trade and FDI liberalization matter

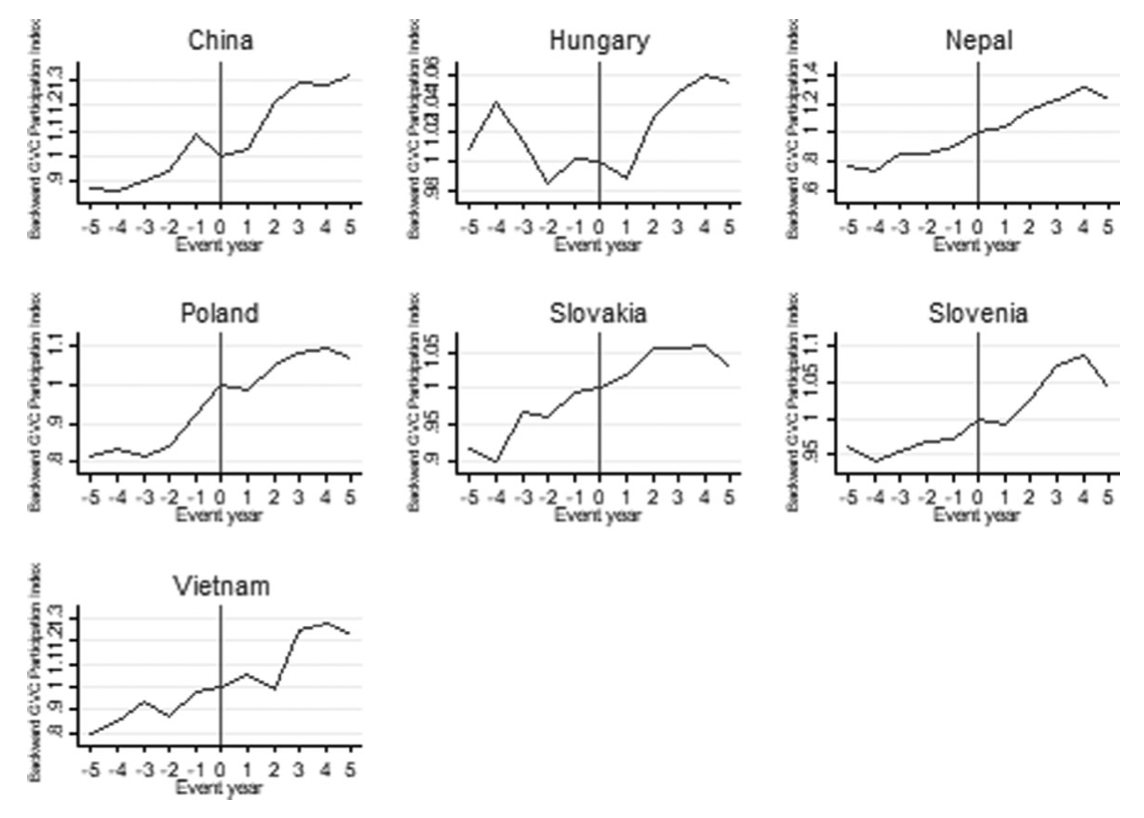

Our event studies find a clear upward trend in GVC participation following trade and FDI liberalization events due to WTO or European Union (EU) accession for a selection of countries.10 The evolution of the GVC index (which equals 1 in the liberalization year) from five years before to five years after such events suggests and upward trend after the event (Figure 2), while a pre-trend before the event is rejected econometrically.

1. Keeping trade costs low is key

Countries at a greater distance from GVC hubs face a higher level of trade frictions and therefore trade costs. Our analysis finds that a shorter distance to the GVC hubs – China, Germany, and the United States – is positively correlated with backward GVC participation.

Geography and thus trade costs are shown to affect GVC trade more strongly than traditional trade. There are several explanations. First, due to the larger number of trade links in a GVC, performance is determined by the strength of the weakest link in the supply chain.9 Second, trade costs affect not only prices of export goods, as is the case for traditional trade, but also those of imported inputs in a GVC.

In the context of the ongoing supply chain disruptions during the COVID-19 pandemic, characterized by increasing shipping prices and longer lead times, these considerations are critical. Higher trade costs will be factored into prices with negative consequences for final consumers. Going forward, it is key to strengthen the resilience of GVCs by improving trade facilitation and connectivity to keep trade costs low, which will be particularly beneficial to GVC participation in remote countries.

2. Trade and FDI liberalization matter

Our event studies find a clear upward trend in GVC participation following trade and FDI liberalization events due to WTO or European Union (EU) accession for a selection of countries.10 The evolution of the GVC index (which equals 1 in the liberalization year) from five years before to five years after such events suggests and upward trend after the event (Figure 2), while a pre-trend before the event is rejected econometrically.

Figure 2: Backward GVC participation increased before and after a trade and FDI liberalization event

Policy barriers on imports and exports, such as tariffs or quotas as well as non-tariff measures, increase trade costs, with consequences for countries’ participation and positioning in GVCs. Our study shows that lower tariffs are significantly linked to higher backward GVC participation across countries and also across country-sectors. Our findings also highlight that tariffs affect backward GVC participation more negatively than traditional trade.

Countries can attract FDI to overcome relative scarcity of capital, technology, and knowledge, and thus integrate into GVCs. Our research confirms the positive effect of FDI inflows on backward GVC participation and the effect is stronger than on traditional exports. This suggests that most of what we capture is the role of export-oriented type of FDI in manufacturing.

These findings highlight that increasing tariffs and constraining FDI inflows have negative effects for countries’ GVC participation and, ultimately, for firms, workers and consumers depending on GVCs. Countries need to resist the urge to increased protectionism in order to strengthen the recovery and resilience of GVCs following the COVID-19 pandemic.

3. Reducing institutional quality is harmful

What distinguishes GVC trade from traditional trade are the intense firm-to-firm interactions characterized by contracting and specialized products and investment.11 Weak contract enforcement is thus a significant deterrent not only for traditional trade, but even more so for GVC trade.

Our research confirms that better institutional quality is linked to higher backward GVC participation. Countries with stronger institutional quality have a comparative advantage in GVC participation of contract-intensive sectors.

The presence of relationship-specific investments (e.g., the customization of products) and the exchange of large flows of intangibles (such as technology, intellectual property, and credit) reinforces the potential role of institutional quality as a significant determinant of relational GVC participation.

In the current context of rising nationalism worldwide, as illustrated by the ongoing law battle between Poland and the EU12, countries need to be aware that reducing institutional quality is harmful to their GVC participation. Countries could instead enhance their institutional quality by entering deep preferential trade agreements which cover legal and regulatory frameworks, harmonize customs procedures, and set rules on intellectual property rights.

Countries can attract FDI to overcome relative scarcity of capital, technology, and knowledge, and thus integrate into GVCs. Our research confirms the positive effect of FDI inflows on backward GVC participation and the effect is stronger than on traditional exports. This suggests that most of what we capture is the role of export-oriented type of FDI in manufacturing.

These findings highlight that increasing tariffs and constraining FDI inflows have negative effects for countries’ GVC participation and, ultimately, for firms, workers and consumers depending on GVCs. Countries need to resist the urge to increased protectionism in order to strengthen the recovery and resilience of GVCs following the COVID-19 pandemic.

3. Reducing institutional quality is harmful

What distinguishes GVC trade from traditional trade are the intense firm-to-firm interactions characterized by contracting and specialized products and investment.11 Weak contract enforcement is thus a significant deterrent not only for traditional trade, but even more so for GVC trade.

Our research confirms that better institutional quality is linked to higher backward GVC participation. Countries with stronger institutional quality have a comparative advantage in GVC participation of contract-intensive sectors.

The presence of relationship-specific investments (e.g., the customization of products) and the exchange of large flows of intangibles (such as technology, intellectual property, and credit) reinforces the potential role of institutional quality as a significant determinant of relational GVC participation.

In the current context of rising nationalism worldwide, as illustrated by the ongoing law battle between Poland and the EU12, countries need to be aware that reducing institutional quality is harmful to their GVC participation. Countries could instead enhance their institutional quality by entering deep preferential trade agreements which cover legal and regulatory frameworks, harmonize customs procedures, and set rules on intellectual property rights.

References:

Antràs, P. (2016). Global Production: Firms, Contracts and Trade Structure, Princeton University Press.

Antràs, P. (2020). “Conceptual Aspects of Global Value Chains,” World Bank Economic Review 34(3): 551-74.

Banh, H., P. Wingender, and C. A. Gueye (2020). “Global Value Chains and Productivity: Micro Evidence from Estonia.” IMF Working Paper No. 20/117.

Baldwin, R. (2016). Globalization’s Three Unbundlings, Harvard University Press.

Borin, A., and M. Mancini (2019). “Measuring What Matters in Global Value Chains and Value-Added Trade.” Policy Research Paper 8804, World Bank, Washington, DC.

Constantinescu, C., A. Mattoo, and M. Ruta (2019). “Does Vertical Specialisation Increase Productivity?” World Economy, 42(8): 2385-402.

Fernandes, A., H. L. Kee, and D. Winkler (2022), “Determinants of Global Value Chain Participation: Cross-Country Evidence,” The World Bank Economic Review, 36(2), 329-360.

Hummels, D., J. Ishii, and K.-M. Yi. (2001). “The Nature and Growth of Vertical Specialization in World Trade,” Journal of International Economics, 54(1): 75-96.

Kasahara, H., and B. Lapham (2013). “Productivity and the Decision to Import and Export: Theory and Evidence,” Journal of International Economics, 89(2): 297-316.

Muûls, M., and M. Pisu (2009). “Imports and Exports at the Level of the Firm: Evidence from Belgium.” The World Economy, 32(5): 692-734.

Pahl, S., and M. Timmer (2020). “Do Global Value Chains Enhance Economic Upgrading? A Long View.” Journal of Development Studies, 56(9): 1683-1705.

Rajan, R., and L. Zingales (1998). “Financial Dependence and Growth.” American Economic Review, 88 (3): 559-86.

Stolzenburg, V., D. Taglioni, and D. Winkler (2019). “Economic Upgrading through Global Value Chain Participation: Which Policies Increase the Value-added Gains?” In Handbook on Global Value Chains, edited by S. Ponte, G. Gereffi, and G. Raj-Reichert, chapter 30, pp. 483-505. Northhampton, MA: Edward Elgar Publishing.

Wagner, J. (2012). “International Trade and Firm Performance: A Survey of Empirical Studies Since 2006,.” Review of World Economics, 148 (2): 235-67.

World Bank. (2019). World Development Report 2020: Trading for Development in the Age of Global Value Chains, Washington, D.C.: World Bank.

Antràs, P. (2016). Global Production: Firms, Contracts and Trade Structure, Princeton University Press.

Antràs, P. (2020). “Conceptual Aspects of Global Value Chains,” World Bank Economic Review 34(3): 551-74.

Banh, H., P. Wingender, and C. A. Gueye (2020). “Global Value Chains and Productivity: Micro Evidence from Estonia.” IMF Working Paper No. 20/117.

Baldwin, R. (2016). Globalization’s Three Unbundlings, Harvard University Press.

Borin, A., and M. Mancini (2019). “Measuring What Matters in Global Value Chains and Value-Added Trade.” Policy Research Paper 8804, World Bank, Washington, DC.

Constantinescu, C., A. Mattoo, and M. Ruta (2019). “Does Vertical Specialisation Increase Productivity?” World Economy, 42(8): 2385-402.

Fernandes, A., H. L. Kee, and D. Winkler (2022), “Determinants of Global Value Chain Participation: Cross-Country Evidence,” The World Bank Economic Review, 36(2), 329-360.

Hummels, D., J. Ishii, and K.-M. Yi. (2001). “The Nature and Growth of Vertical Specialization in World Trade,” Journal of International Economics, 54(1): 75-96.

Kasahara, H., and B. Lapham (2013). “Productivity and the Decision to Import and Export: Theory and Evidence,” Journal of International Economics, 89(2): 297-316.

Muûls, M., and M. Pisu (2009). “Imports and Exports at the Level of the Firm: Evidence from Belgium.” The World Economy, 32(5): 692-734.

Pahl, S., and M. Timmer (2020). “Do Global Value Chains Enhance Economic Upgrading? A Long View.” Journal of Development Studies, 56(9): 1683-1705.

Rajan, R., and L. Zingales (1998). “Financial Dependence and Growth.” American Economic Review, 88 (3): 559-86.

Stolzenburg, V., D. Taglioni, and D. Winkler (2019). “Economic Upgrading through Global Value Chain Participation: Which Policies Increase the Value-added Gains?” In Handbook on Global Value Chains, edited by S. Ponte, G. Gereffi, and G. Raj-Reichert, chapter 30, pp. 483-505. Northhampton, MA: Edward Elgar Publishing.

Wagner, J. (2012). “International Trade and Firm Performance: A Survey of Empirical Studies Since 2006,.” Review of World Economics, 148 (2): 235-67.

World Bank. (2019). World Development Report 2020: Trading for Development in the Age of Global Value Chains, Washington, D.C.: World Bank.

Endnotes:

1 Baldwin (2016).

2 Our paper relies on the backward GVC participation measure of Borin and Mancini (2019), which captures the import content of exports of a country, originally referred to as the vertical specialization index in Hummels, Ishii, and Yi (2001).

3 Antràs (2016, 2020).

4 World Bank (2019).

5 Constantinescu, Mattoo, and Ruta (2019); World Bank (2019); Stolzenburg, Taglioni, and Winkler (2019); Pahl and Timmer (2020). At the firm level, considering firms that import intermediate inputs and export as participating in GVCs, the evidence clearly shows that they benefit in terms of higher productivity, capital intensity, and employment relative to firms that engage only in exports (Muûls and Pisu 2009; Wagner 2012; Kasahara and Lapham 2013; World Bank 2019; Banh, Wingender, and Gueye 2020).

6 Fernandes, Kee and Winkler (forthcoming).

7 We use instrumental variables estimation to address the potential endogeneity of trade liberalization and FDI in the cross-country regressions. Our paper also uses a difference-in-difference framework following Rajan and Zingales (1998) for cross-country cross-sector regressions to sidestep endogeneity concerns for other determinants, such as endowments or institutions.

8 The choice of determinants of GVC participation draws heavily on Antràs (2020) and World Bank (2019).

9 Antràs (2020).

10 For readability, we only show three countries in Figure 2, while our analysis covers seven countries.

11 Antràs (2016, 2020).

12 https://www.france24.com/en/europe/20211027-eu-court-fines-poland-1-2-million-per-day-as-rule-of-law-row-escalates

1 Baldwin (2016).

2 Our paper relies on the backward GVC participation measure of Borin and Mancini (2019), which captures the import content of exports of a country, originally referred to as the vertical specialization index in Hummels, Ishii, and Yi (2001).

3 Antràs (2016, 2020).

4 World Bank (2019).

5 Constantinescu, Mattoo, and Ruta (2019); World Bank (2019); Stolzenburg, Taglioni, and Winkler (2019); Pahl and Timmer (2020). At the firm level, considering firms that import intermediate inputs and export as participating in GVCs, the evidence clearly shows that they benefit in terms of higher productivity, capital intensity, and employment relative to firms that engage only in exports (Muûls and Pisu 2009; Wagner 2012; Kasahara and Lapham 2013; World Bank 2019; Banh, Wingender, and Gueye 2020).

6 Fernandes, Kee and Winkler (forthcoming).

7 We use instrumental variables estimation to address the potential endogeneity of trade liberalization and FDI in the cross-country regressions. Our paper also uses a difference-in-difference framework following Rajan and Zingales (1998) for cross-country cross-sector regressions to sidestep endogeneity concerns for other determinants, such as endowments or institutions.

8 The choice of determinants of GVC participation draws heavily on Antràs (2020) and World Bank (2019).

9 Antràs (2020).

10 For readability, we only show three countries in Figure 2, while our analysis covers seven countries.

11 Antràs (2016, 2020).

12 https://www.france24.com/en/europe/20211027-eu-court-fines-poland-1-2-million-per-day-as-rule-of-law-row-escalates