︎

Frauke Steglich

Kiel Institute for the World Economy

Frauke Steglich is a Researcher at the Kiel Institute for the World Economy (IfW), Managing Director of the Poverty Reduction, Equity and Growth Network (PEGNet) at IfW, and Research Fellow at the Kiel Centre for Globalization (KCG). Her research interests lie in the field of empirical international economics and development, with a focus on foreign direct investment, global value chains, and corporate social responsibility.

MORE ABOUT FRAUKE STEGLICH >Jan 1, 2020

Julian Glitsch, Olivier Godart, Holger Görg, Saskia Mösle, Frauke Steglich

Lagging behind? German Foreign Direct Investment in Africa

German Foreign Direct Investment (FDI) in Africa is lagging behind China, France, the Netherlands, the UK, the US, and other economies. It represented only 1 percent of the German total FDI stock abroad in 2018 and is concentrated in few African countries. Overall, around 8...

Jan 1, 2020

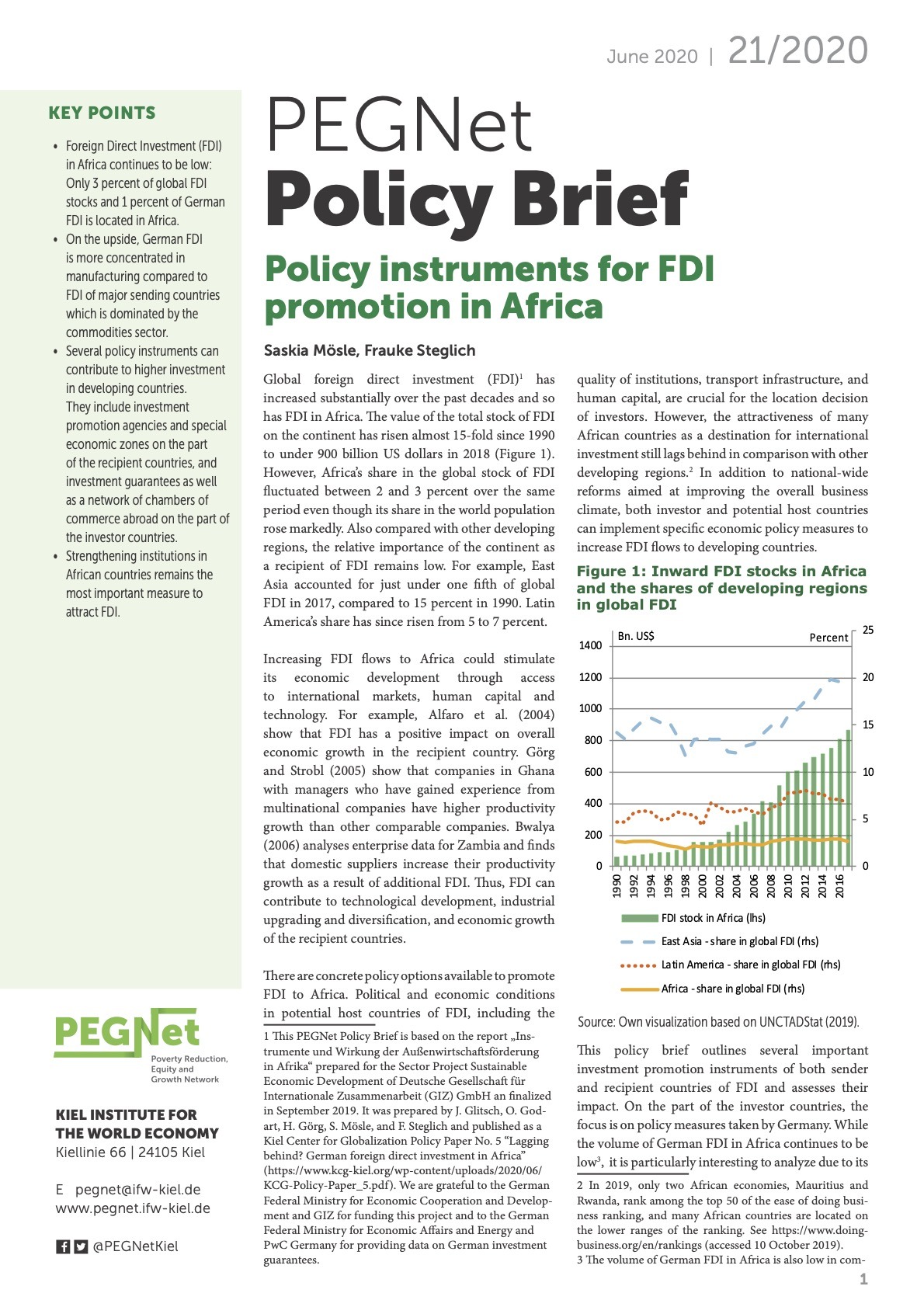

Saskia Mösle, Frauke Steglich

Policy instruments for FDI promotion in Africa

Global foreign direct investment (FDI) has increased substantially over the past decades and so has FDI in Africa. However, still only 3 percent of global FDI stocks and 1 percent of German FDI is located in Africa. There are several policy instruments that can contribute to higher investment in dev...

Apr 5, 2022

Sustainable Global Supply Chains Report 2022

Global supply chains affect the economy, the environment and social welfare in many ways. Worldwide, economies are experiencing global supply shortages today, affecting key industries such as automotive and consumer electronics as well as vaccine and medical supplies industries. These preoccupy poli...

Jan 12, 2022

Philipp Herkenhoff, Sebastian Krautheim, Finn Ole Semrau, Frauke Steglich

Corporate Social Responsibility along the Global Value Chain

Firms are under increasing pressure to meet stakeholders’ demand for Corporate Social Responsibility (CSR) along their global value chains. We study the incentives for and investments in CSR at different stages of the production process. We analyze a model of sequential production with incomplete ...

Nov 12, 2021

Peter Kannen, Finn Ole Semrau, Frauke Steglich

Green gifts from abroad? FDI and firms’ green management

Improvements of firms' environmental performance crucially determine the speed of a country's green economic transformation. In this paper, we investigate whether firms with foreign ownership are more likely to adopt 'green' management practices, which determine the capability to...

Sep 16, 2021

Holger Görg, Jann Lay, Stefan Pahl, Adnan Seric, Frauke Steglich, Liubov Yaroshenko

Multilateral coordination and exchange for sustainable global value chains

While participation in global value chains (GVCs) is widely associated with benefits for countries’ development and growth, its environmental and social costs become increasingly evident. Representing core buyer and supplier countries in GVCs, the G20 is particularly suited to tackle this global c...

Sep 1, 2021

Julian Donaubauer, Peter Kannen, Frauke Steglich

Foreign Direct Investment & Petty Corruption in Sub-Saharan Africa: An Empirical Analysis at the Local Level

Inspired by a recent and ongoing debate about whether foreign direct investment (FDI) represents a blessing for or an impediment to economic, social, and political development in FDI host countries this paper addresses two issues: Does the presence of foreign investors impact the occurrence of petty...

Jan 30, 2024

“Sustainable global supply chains in times of geopolitical crises” Annual Report 2023

The overarching topic of this year's report is "The Role of Geopolitics in Global Supply Chains", highlighting ways in which recent geopolitical and geo-economic developments are shaping and influencing current debates and policy processes around global supply chains (GSCs). Following...

Feb 12, 2024

Jann Lay, Tilman Altenburg, Melanie Müller, Tevin Tafese, Rainer Thiele, Frauke Steglich

Europäische Lieferkettenregulierung nicht aufhalten! Sie ist ein wichtiger Schritt für eine bessere Globalisierung